Charitable Donations in Your Will: Ensuring Your Legacy Supports Meaningful Causes

Including charitable donations in your will is a powerful way to leave a lasting legacy and support causes that reflect your values.

In British Columbia, there are several ways to structure charitable gifts in your estate plan, each with unique tax and legal considerations. Whether you're leaving a specific bequest, a residual amount, or establishing a charitable trust, thoughtful planning ensures your intentions are honoured and your estate is managed efficiently.

This article outlines key strategies for incorporating charitable donations into your will while maximizing their impact.

Understanding Charitable Donations in Your Will

Charitable donations through your will let you direct some of your assets to organizations that matter to you. This method can benefit your estate and help charitable causes across Canada.

Definition of Charitable Bequests

A charitable bequest is when you allocate a gift to a charity in your will. Common options include money, investments, property, or even a share of your estate. This is also known as a planned gift because you decide on it in advance, ensuring your wishes are respected after your passing.

You may specify an exact amount, a percentage of your estate, or particular items. For example, you might leave 5% of your estate to a local food bank. This can be done using clear instructions in your will, making the transfer smooth for your executor and the charity.

Charitable bequests allow you to support causes you care about, no matter the size of your estate. Including a gift in your will is an effective way to make a lasting impact, even if you must keep your assets during your lifetime.

Eligibility of Charities

Not all organizations can receive charitable donations through your will. To qualify, the charity must be a registered Canadian charity with the Canada Revenue Agency (CRA). This ensures your estate can benefit from potential tax relief.

You can confirm a group’s eligibility by checking the CRA’s online database. If you give to an unregistered organization, your estate may not receive tax benefits, and your wishes may not be carried out as intended.

Large, national organizations and small, local charities may all qualify if registered. It is important to check the legal name and registration number of the charity you wish to include. This helps your executor make sure the donation goes to the right place and meets CRA requirements.

Legal Framework in Canada

Wills and charitable gifts are guided by Canadian law. You must have a valid will that states your intention to donate and names the charity. The will must be properly signed, witnessed, and follow provincial requirements.

When you leave a gift to a registered charity, your estate can claim a charitable donation tax credit. This may reduce the amount of tax owed by your estate, sometimes significantly.

It is helpful to consult a lawyer with experience in estate planning. They can make sure your will is legal and the donation meets Canadian law. These steps make your gift more likely to reach the intended charity with minimal delay.

Types of Charitable Gifts in Estate Planning

There are several main ways to leave charitable gifts through your estate. Each type of gift offers unique advantages and can be tailored to reflect your personal wishes and support your preferred charities.

Specific Bequests

A specific bequest means you leave a designated amount of money or a particular asset, such as shares or real estate, to a charity. This is the most direct way to ensure a charity receives exactly what you intend. The item or amount is clearly stated in your Will, so there is less chance of confusion or dispute later.

For example, you could state in your Will that a charity should receive $10,000 or a specific piece of artwork. This method gives you clear control over what is given and allows you to support a cause with a known asset. Specific bequests can be used for cash, personal property, or even stocks.

A major advantage is that the charity knows exactly what it will receive. This can make planning easier both for you and for the charity.

Residual Bequests

A residual bequest is a gift of all or a percentage of what remains in your estate after all debts, expenses, and other gifts have been paid. This means you allow other obligations to be settled first, and then the residue—what is left over—goes to your chosen charity or charities.

If you want to make sure family needs are met first, but still wish to support a charity, this option may be suitable. You can choose whether the charity gets all the residue or just a certain percentage.

Residual gifts can be especially helpful for charities because they may increase in value as the total estate grows. They also offer flexibility, since they account for changes in your estate’s value over time.

Contingent Bequests

A contingent bequest is a gift that only takes effect if a certain condition is met. Most often, this involves leaving assets to a charity if your main beneficiaries cannot inherit. For example, your Will could state that a charity receives your estate only if your beneficiaries have passed away before you.

Contingent bequests can serve as a backup plan. They provide a way to support a charity if your preferred arrangements are not possible. This approach helps you prepare for unexpected changes in your family or circumstances.

You can use contingent bequests to ensure your assets benefit a meaningful cause, no matter what happens.

Tax Implications of Charitable Giving in Your Will

Making a charitable donation through your will can lower your estate’s taxes and provide valuable credits. These credits may reduce tax owed in your final personal tax return or by your estate when the gift is made.

Income Tax Benefits

Charitable gifts in your will qualify for a donation tax credit. This credit is based on the value of the gift given to a registered charity.

Your executor can choose to apply this donation tax credit to either your final personal tax return or your estate’s tax return. If the gift is made by the estate, the credit can be used in the year of the donation or carried forward to future years.

The amount of tax credit depends on the gift amount. When large donations are made, it is sometimes possible to eliminate almost all tax owing in your final year. The specific rules surrounding donation credits and claim limits can be complex.

Capital Gains Tax Considerations

If you leave securities or other investments to a charity through your will, you may avoid paying tax on capital gains from those assets. Canadian tax rules allow for a reduced or eliminated capital gains tax on publicly traded securities donated to a registered charity.

This means, for example, that if you donate shares that have increased in value, the capital gain is not taxed. This tax treatment encourages you to gift appreciated assets instead of cash where possible.

By structuring your charitable gift with investments, your estate may see even more significant savings.

Tax Credits for Estates

When your estate makes a donation to a charity, the tax credit can be claimed in the year of the donation or spread out over up to five years after the donation is made. The executor often provides the required proof of the gift, such as an official donation receipt or a copy of your will.

These credits can only be claimed up to certain limits, usually a percentage of your net income. For some unique gifts, like ecologically sensitive land, the carry-forward period is even longer.

Using donation tax credits can help reduce estate taxes and increase the amount left for your heirs.

Steps to Include Charitable Donations in Your Will

Including charitable donations in your will requires careful planning, informed choices, and clear legal documentation. You will need to choose charities that qualify, work with professionals, and ensure your instructions are outlined clearly in your will.

Selecting Eligible Charities

You must confirm that the charity you wish to support is a registered non-profit organisation. In Canada, most registered charities are listed with the Canada Revenue Agency and have a registration number. Giving to a registered charity can support causes ranging from healthcare, education, and animal welfare to environmental protection.

Take time to research the charity’s reputation, track record, and financial management. Charities with transparent goals, stable leadership, and established governance are usually good choices. Using directories or checking official websites can help verify this information.

Consider if you want your donation to support a specific project, create a fund, or be used wherever the charity needs it most. Communicate with the charity if you have specific wishes so they can advise on wording and administration. Detailed planning ensures your charitable bequest has the intended impact.

Consulting with Legal and Financial Advisors

It is important to get advice from a lawyer or estate planning professional when including donations in your will. An experienced advisor can explain tax benefits, help avoid unintended consequences, and ensure your will is valid under Canadian law.

A financial advisor may help you decide how much to give and how the donation will affect your estate and your beneficiaries. They can give you options, such as donating a fixed amount, a percentage of your estate, or assets like securities or property.

Meeting with advisors also helps clarify any tax advantages your estate may receive. Proper planning can increase the value of your gift and reduce taxes your estate must pay. Advisors can also work with representatives from your chosen charities if further guidance is needed.

Drafting Appropriate Will Clauses

Once you have chosen your charities and consulted with professionals, you will need to draft clear, specific clauses in your will. The clause should name the charity using its legal name and registration number to avoid confusion.

A typical charitable bequest clause might look like this:

"I give the sum of $10,000 to [Charity Name], [Charity Address], Registered Charity Number [123456789RR0001], to be used at its discretion."

You can specify if the gift should be used for a particular purpose, such as research or supporting a local branch. Be precise to ensure your wishes can be followed. Make sure your will is signed, dated, and complies with the legal requirements in your province.

Common Mistakes to Avoid When Bequeathing to Charities

Making a charitable donation in your will is a generous act, but certain errors can cause problems. Using the correct charity information and keeping your details updated are crucial for your wishes to be carried out as intended.

Incorrect Charity Identification

Choosing the right charity may seem simple, but mistakes with names or details can create confusion. Many organizations have similar names or operate under several legal titles. If you do not include the official name and Charitable Registration Number, your gift could be delayed or even go to the wrong cause. A gift left to a non-registered charity may not get the tax benefits you expect, and the charity may be unable to accept the donation.

To avoid errors:

Use the full legal name of the charity.

Add the Charitable Registration Number in your will.

Look up the details on the charity’s website or the list provided by the Canada Revenue Agency.

Precise identification helps ensure your gift is honoured as you intend.

Outdated Beneficiary Information

Charity names, purposes, and addresses may change over time. If your will lists outdated information, it may be hard for your executor to locate or contact the charity. Sometimes, charities merge with others, split apart, or even close. If you do not update your will regularly, your intended gift could fail or require court intervention to redirect it.

To manage this risk:

Review your will after major life changes or every few years.

Keep track of any news or changes from the charities you name.

Consult a lawyer to update your will if necessary.

Making sure your will has current information protects your intended bequest.

Updating and Reviewing Charitable Bequests

It is important to regularly review and update the charitable bequests in your Will. Changes in your life, such as marriage, divorce, or the birth of a child, may affect your wishes.

You may need to update the legal name of a charity to ensure it is accurate. Using official lists, like the Government of Canada’s charities list, can help confirm you are naming the correct organization.

When to review your charitable bequests:

After major life events

If your financial situation changes

When the charity changes its name or status

If you want to add, remove, or change the amount given

Working with a lawyer or estate planner ensures your updates are valid. Regular reviews help make sure your Will reflects your current goals and honours your intentions.

Tip: Keep a list of all the charities named in your Will and their contact details. This helps prevent confusion and delays later on.

Updating your Will can be simple. Sometimes a short written amendment, called a codicil, is enough. In other cases, a new Will may be required.

By keeping your documents current, you help avoid common problems and make sure the organizations you care about receive your gift.

Role of Executors in Administering Charitable Gifts

When you leave a charitable gift in your will, your executor is responsible for carrying out your wishes. Their role begins once the will is validated through probate.

Your executor must identify the gift and confirm the recipient's status as a registered charity. This may include verifying the charity’s legal name and registration number for accuracy.

Key duties include:

Notifying the charity of your intended gift

Handling the transfer of cash, shares, property, or other assets

Collecting proper receipts and documentation

Executors need to obtain official donation receipts from the charity. These receipts are important for the estate’s final tax return. Your executor may need to provide the will, a letter detailing the gift, and correspondence from the charity to properly document the donation.

In some cases, your executor has the flexibility to choose the most tax-efficient way to deliver charitable gifts. This could mean donating cash or assets in kind, based on your instructions and what is best for the estate.

Your executor plays a central part in making sure your charitable intentions are followed and properly recorded. Proper care at each step helps support compliance with both your wishes and the law.

Charitable Donations Versus Other Forms of Legacy Giving

Charitable donations in your Will are a direct and often familiar way to support a cause you care about.

Other forms of legacy giving may offer different options. For example, you can set up recurring gifts that start while you are living and continue after your death. You also have the choice to leave assets such as real estate, art, or company shares to organizations.

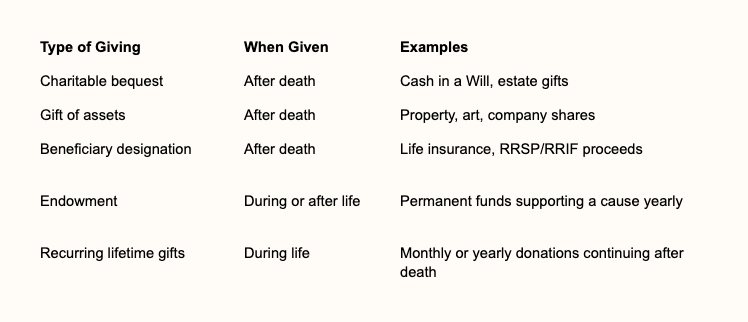

Common types of legacy giving include:

Charitable bequests (gifts through your Will)

Gifts of real estate or other tangible assets

Beneficiary designations (like life insurance policies or RRSPs)

Endowments (funds set up to support a cause over time)

Legacy giving choices allow you to match your personal values with the needs of organizations. Each method offers its own benefits, depending on your goals and financial situation.

The Final Verdict

Charitable giving through your will is a meaningful and effective way to support the causes you care about, while also providing potential tax benefits for your estate. To ensure your charitable intentions are clearly documented and legally enforceable, it’s essential to plan carefully.

For assistance with structuring charitable gifts in your estate plan, contact the lawyers at Parr Business Law. Our team can help you honour your legacy and ensure your generosity has a lasting impact.