TFSA Beneficiary Designation Rules And Tax Implications

Tax-Free Savings Accounts (TFSAs) are a valuable estate planning tool, but many Canadians are unaware of how beneficiary designations affect the transfer of funds after death.

Properly naming a beneficiary or successor holder can help ensure a smooth and tax-efficient transition of assets. However, the rules and potential tax implications can vary depending on whom you designate and how your account is structured.

This article explains the key TFSA beneficiary designation rules, the difference between a beneficiary and a successor holder, and the potential tax consequences for your estate and heirs.

What Is a TFSA Beneficiary?

A Tax-Free Savings Account (TFSA) beneficiary is the person or entity you name to receive the funds in your TFSA after your death. This designation affects how the funds are transferred, who can receive them, and whether any taxes apply. Understanding this helps ensure your savings go to the right person efficiently.

Definition and Legal Meaning

A TFSA beneficiary is someone you legally designate to receive the remaining funds in your TFSA when you pass away. This designation is made directly with your TFSA issuer, not in your will.

Unlike a successor holder, a beneficiary does not take over the TFSA account itself. Instead, they receive the funds as a lump-sum payment, which is generally tax-free up to the date of death.

You can name more than one beneficiary and specify how the funds should be divided. The designation must comply with the laws of your province, as provincial legislation governs how these designations are recognized.

More details on how the TFSA issuer handles ownership and reporting can be found on the Government of Canada’s TFSA successor holder page.

Types of Beneficiaries

You can name individuals or organizations as beneficiaries. Individuals may include family members, friends, or anyone you wish to inherit the funds. Organizations can include charities or other legal entities.

If you name your spouse or common-law partner, you may instead choose to designate them as a successor holder, which allows them to take over the TFSA directly. Other beneficiaries, such as children, siblings, or charities, can only receive a payout.

The table below outlines the main differences:

Eligibility Criteria

Any individual or legal entity can be named as a beneficiary, but only a spouse or common-law partner qualifies as a successor holder. You must be a Canadian resident when opening the TFSA, but your beneficiary can live in or outside Canada.

Children, relatives, friends, or charities are all eligible as beneficiaries. However, minors may require a trustee to manage the funds until they reach the age of majority.

You should confirm that your financial institution recognizes the designation under your province’s laws. Some provinces require specific forms or wording for the designation to be valid.

Designating a TFSA Beneficiary

You can choose who will receive the funds in your Tax-Free Savings Account (TFSA) after your death. The process involves naming a beneficiary, deciding how that designation is made, and knowing how to change it later if your situation changes.

How to Name a Beneficiary

You can name a beneficiary directly on your TFSA application or through a separate designation form provided by your financial institution. The person you name may be a spouse, common-law partner, family member, or another individual.

If you name your spouse or common-law partner as a successor holder, they can take over your TFSA and keep its tax-free status. Other beneficiaries receive the funds but cannot continue the account itself.

According to the Canada Revenue Agency, the designation can also be made in your will, but doing so directly through the TFSA provider helps avoid delays and probate. Always confirm that your province allows direct designations, as rules can vary.

Common Designation Methods

There are two main ways to transfer TFSA assets after death: successor holder and beneficiary.

Naming a spouse as the successor holder is often the most efficient option. You may also name alternate beneficiaries in case the primary one dies before you.

Changing or Revoking a Beneficiary

You can change or revoke your TFSA beneficiary at any time by completing a new designation form with your financial institution. It is important to update this information after major life events such as marriage, divorce, or the death of a named beneficiary.

If your designation conflicts with your will, the TFSA form usually takes priority. Ensure that both documents match to avoid confusion.

Some provinces have specific rules about how designations must be made or revoked. These rules can differ by jurisdiction, so check with your financial institution or legal advisor to confirm what applies to you.

Successor Holder vs. Beneficiary

When you name someone on your Tax-Free Savings Account (TFSA), the role you assign affects how the account is handled after your death. The two main designations—successor holder and beneficiary—determine who owns the account and how taxes apply.

Key Differences

A successor holder becomes the new owner of your TFSA immediately after your death. This option is available only if the person is your spouse or common-law partner. The account keeps its tax-free status, and no withdrawal or transfer is required. The TFSA continues as if it were always theirs.

A beneficiary, on the other hand, receives the funds from your TFSA but not the account itself. The tax-free status ends on the date of death. Any income earned after that date is taxable to the beneficiary. You can name anyone as a beneficiary, including family members or friends.

Implications for Spouses and Common-Law Partners

If your spouse or common-law partner is named as a successor holder, they can combine your TFSA with their own without affecting their contribution room. This keeps the account’s tax-free growth intact and avoids administrative delays.

If they are named only as a beneficiary, they must transfer the funds to their own TFSA using an “exempt contribution” within the allowed time. Otherwise, the transfer may count toward their contribution limit.

Only a spouse or common-law partner can receive the tax-exempt continuation of a TFSA. For others, the account must close, and any post-death income becomes taxable. These distinctions can affect how you plan your estate and ensure your savings are transferred efficiently.

Tax Implications for TFSA Beneficiaries

You may face different tax outcomes depending on whether you are named as a successor holder or a beneficiary. The fair market value of the TFSA at the time of death and how the funds are handled afterward determine if any income becomes taxable. Clear reporting and timely action help prevent penalties or loss of tax advantages.

Tax Treatment Upon Death

When a TFSA holder dies, the account’s fair market value immediately before death remains tax-free. According to the Canada Revenue Agency, this amount can be paid to the named beneficiary without income tax.

If you are a successor holder—usually a spouse or common-law partner—you can take over the TFSA and keep its tax-exempt status. You may merge it with your own TFSA or maintain it as a separate account.

If you are a designated beneficiary (not a spouse or partner), you receive the funds tax-free up to the date of death. However, any income earned after death becomes taxable. The TFSA issuer must calculate this post-death income and issue a T4A slip showing the taxable amount.

TFSAs with named beneficiaries are also excluded from probate in most provinces, which can help reduce estate administration costs.

Reporting Requirements

You must report any income earned after the holder’s death from the TFSA on your personal tax return. The TFSA issuer provides the necessary slips, such as the T4A, to help you include this income accurately.

If you are a successor holder, you do not have to report anything because the TFSA continues under your name with its tax-free status intact.

Keep records of the date of death, account value, and any distributions. The Canada Revenue Agency may request these details to confirm that the tax-free portion and taxable income were handled correctly.

When transferring assets, ensure the funds move directly between TFSA accounts to preserve tax benefits. Withdrawals followed by re-contributions could unintentionally exceed your TFSA contribution limit.

Potential Penalties

You may face penalties if you over-contribute to your TFSA when transferring inherited funds. The CRA charges a 1% monthly penalty on the excess amount until it is withdrawn.

Failing to report taxable income earned after death can also result in interest and late-filing penalties. Make sure to verify all amounts reported on your tax slips before filing your return.

If you are unsure about your limits, contact the CRA or review your My Account online to confirm your available TFSA contribution room.

To avoid compliance issues, work with the TFSA issuer and, if needed, a financial advisor to ensure all transactions meet CRA rules. Proper documentation and timely reporting protect your tax-free status and prevent unnecessary charges.

Process After Death of a TFSA Holder

When a TFSA holder dies, the account’s treatment depends on who is named as the successor holder or beneficiary. The value of the TFSA at the time of death is generally tax-free, but income earned after death may be taxable if not transferred properly. Understanding the process helps you manage the account efficiently and avoid tax issues.

Claiming the TFSA

If you are the successor holder—usually a spouse or common-law partner—you automatically become the new holder of the TFSA upon death. The account continues as your own, and the funds remain tax-free as long as there was no excess contribution at the time of death.

If you are a designated beneficiary instead, you receive the TFSA’s fair market value as of the date of death tax-free. However, any growth or income earned after that date is taxable. The Canada Revenue Agency explains that this distinction affects how the transfer is processed and reported.

You should contact the financial institution as soon as possible to notify them of the account holder’s death and confirm your designation status. This step ensures the TFSA is handled correctly and prevents delays in transferring or closing the account.

Required Documentation

You must provide specific documents to claim or transfer the TFSA. These usually include:

Death certificate

Proof of identity of the beneficiary or successor holder

Copy of the will or estate documents, if applicable

Financial institution forms confirming your role and claim

The institution may also request a probate document if the estate must go through probate. The CIBC guide on TFSAs after death notes that the process differs depending on whether a successor holder or beneficiary is named.

Submitting complete and accurate paperwork helps confirm your entitlement and allows the transfer or payment to proceed without unnecessary delays.

Distribution Timeline

The timeline for distributing TFSA funds varies based on the account type and documentation provided. If you are a successor holder, the transfer can occur quickly once the financial institution verifies your status. The TFSA continues under your name without interruption.

For beneficiaries, the process may take longer. The estate must first determine the account’s value at death, then release the funds. This ensures accurate tax reporting and proper allocation of post-death income.

Most distributions are completed within a few weeks to a few months, depending on estate complexity and how promptly documents are submitted. Timely communication with the financial institution helps you receive funds efficiently.

Impact on Estate Planning

Designating a beneficiary for your Tax-Free Savings Account (TFSA) affects how your savings are transferred after death and how easily your estate can be settled. Proper planning helps you minimize administrative costs and ensure your assets go directly to the intended person.

Avoiding Probate

When you name a successor holder or designated beneficiary for your TFSA, the account can often bypass probate. This means the funds may transfer directly to the beneficiary without being included in your estate’s total value. Avoiding probate helps reduce fees and delays.

If your spouse or common-law partner is named as a successor holder, they can take over the TFSA and maintain its tax-free status. This transfer does not affect their own contribution room.

For non-spouse beneficiaries, the account usually closes, and the funds are paid out tax-free as of the date of death. Any income earned after that date may be taxable.

Coordinating with Wills

You should align your TFSA beneficiary designations with your will to prevent conflicts. If your will names a different person than your TFSA form, the TFSA designation usually overrides the will. This can cause confusion among heirs if not reviewed carefully.

Keep your documents consistent and updated. You may also name alternate beneficiaries who receive the funds only if the main beneficiary dies before you.

Create a simple record of all your designations:

This coordination ensures your estate plan remains clear and legally sound.

Common Issues and Considerations

You may face challenges when managing or inheriting a Tax-Free Savings Account (TFSA). These often involve disputes over designations, dividing funds among several beneficiaries, or handling accounts for individuals with special needs or complex legal situations.

Contesting Beneficiary Designations

Disputes can arise when family members question the validity of a TFSA beneficiary designation. This may happen if the form was completed incorrectly, signed under pressure, or not updated after major life events such as marriage or divorce.

You should review your TFSA paperwork regularly to confirm that designations match your current intentions. A valid designation ensures that funds transfer smoothly and without probate delays.

If a designation is contested, the TFSA proceeds may become part of the estate until the dispute is resolved. This can lead to delays and potential tax consequences. Keeping clear records and communicating your choices to your executor and family can reduce the risk of conflict.

Multiple Beneficiaries

When you name more than one beneficiary, you must specify how the TFSA balance will be divided. You can assign equal or unequal shares, but unclear instructions may cause confusion or disputes.

Financial institutions typically require written direction on each beneficiary’s percentage. If the total does not add up to 100%, the institution may apply its own default rules. Clear designations help avoid probate and ensure each person receives the correct amount.

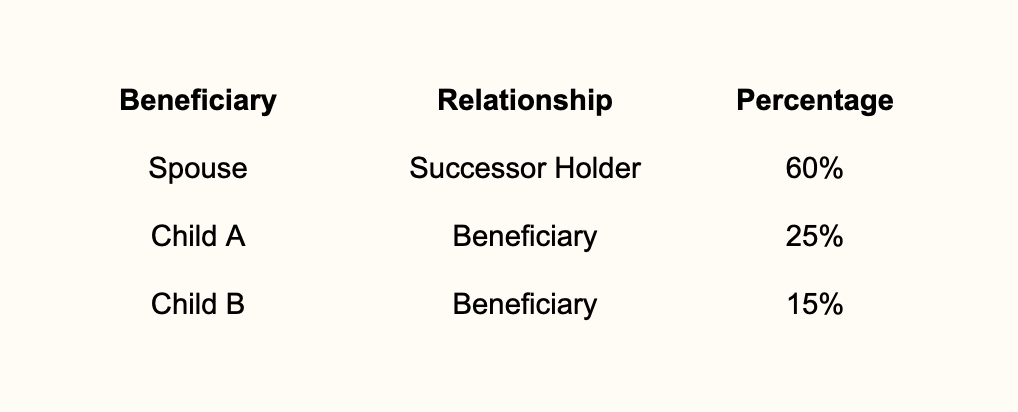

Example Table:

You should also consider naming alternate beneficiaries in case one predeceases you. This prevents your TFSA from reverting to your estate unnecessarily.

Beneficiaries with Special Circumstances

Some beneficiaries may have special considerations, such as minors, dependants with disabilities, or individuals receiving government benefits. In these cases, direct transfers may not be appropriate.

You can set up a trust or name a legal guardian to manage the funds on behalf of a minor. For beneficiaries with disabilities, using a trust arrangement can protect their eligibility for income-tested benefits.

You should consult an estate planner before finalizing these designations. Proper planning ensures that your TFSA benefits your chosen recipients in a way that aligns with both legal and financial requirements.

TFSA Beneficiary Rules by Province

All provinces and territories except Quebec allow you to make beneficiary or successor holder designations directly in your TFSA contract. In Quebec, you must make the designation through your will instead.

If your spouse or common-law partner is named as a successor holder, they can take over your TFSA and keep its tax-free status. If they are named only as a beneficiary, the account will be paid out, and future earnings will be taxable.

Updating TFSA Beneficiary Information

You should review your Tax-Free Savings Account (TFSA) beneficiary information regularly. Life changes such as marriage, divorce, or the birth of a child may affect who you want to receive your TFSA after your death. Keeping your designations current helps ensure your savings go to the intended person.

When you update your TFSA, you can name either a successor holder or a beneficiary. A successor holder can only be your spouse or common-law partner and can take over your TFSA without affecting their own contribution room. A beneficiary receives the funds directly but does not continue the account.

If you have both a successor holder and a beneficiary listed, the successor holder designation overrides the beneficiary. You should complete a new designation form whenever you make changes to either one.

Most financial institutions, such as TD and CIBC, require a specific form to update your TFSA beneficiary or successor holder. In Quebec, these designations can only be made in a will or marriage contract.

The Final Verdict

Making informed TFSA beneficiary designations is essential to preserving the tax advantages of your savings and ensuring they are passed on according to your wishes. Understanding the rules and implications can help prevent unexpected taxes or delays for your heirs.

For expert guidance in aligning your TFSA with your broader estate plan, contact the attorneys at Parr Business Law. Our team can help you navigate beneficiary designations and secure a smooth, tax-efficient transfer of your assets.