Digital Assets and Modern Estate Considerations in BC: Legal Implications and Best Practices

As our lives become increasingly digital, modern estate planning must account for digital assets such as online accounts, cryptocurrencies, digital photos, and cloud-stored documents.

In British Columbia, managing these assets requires careful planning to ensure they are accessible, properly transferred, or securely deleted in accordance with your wishes.

This article examines the legal implications of digital assets in estate planning and offers best practices for including them in your will or trust, helping you protect both your digital legacy and your loved ones.

Defining Digital Assets in Estate Planning

Digital assets have become an important part of estate planning in British Columbia. You need to identify what digital assets you own, who controls them, and how they can be valued for legal and administrative purposes. These steps help you manage your estate and protect your interests.

Common Types of Digital Assets

Digital assets include data, files, and accounts that exist electronically. Some carry financial value, while others hold sentimental or personal significance. Important types are email accounts, social media profiles, digital photos, videos, and cloud storage. You may also have digital currencies, online banking accounts, and loyalty or rewards points.

Intellectual property, such as blogs, websites, and e-books, are also considered digital assets. Domain names, online business stores, and digital art belong in this group as well. Personal digital records, like e-statements or tax files, should be included in your estate plan.

Checklist of Digital Assets to Include in an Estate Plan

Email accounts (Gmail, Outlook, Yahoo, etc.)

Social media profiles (Facebook, Instagram, Twitter/X, LinkedIn, etc.)

Online banking and investment accounts

Cryptocurrency holdings and digital wallets (Bitcoin, Ethereum, NFTs, etc.)

Cloud storage accounts (Google Drive, Dropbox, iCloud, Microsoft OneDrive)

Digital media libraries (iTunes, Kindle, Amazon Prime, Spotify)

Domain names and personal websites

Online businesses and e-commerce stores

Loyalty and rewards programs (frequent flyer miles, hotel points, credit card rewards)

Online payment services (PayPal, Apple Pay, Google Wallet, Venmo)

Digital photos, videos, and documents stored on devices or in the cloud

Online subscription accounts (Netflix, Hulu, news subscriptions, software licenses)

Intellectual property in digital form (blogs, ebooks, digital art)

Gaming accounts and in-game assets

Online utility and service accounts

Stored passwords and credentials (often managed via a password manager)

Ownership and Control of Digital Properties

Ownership of digital assets can be complex. Some accounts, such as email and social media, are often controlled through service agreements rather than outright ownership. You must check every account’s terms of service to confirm what you own and what you only have permission to use.

You can simplify access by maintaining an updated list of usernames, passwords, and security details. Legal documents, such as a will or a power of attorney, should explicitly state who has authority to access and manage your digital properties if you are incapacitated or deceased. Without clear instructions, your executor may face obstacles in dealing with social media, banking apps, or online investments. Review the terms and policies of each provider before including digital assets in your estate plan.

Digital Asset Valuation Methods

Valuing digital assets can be straightforward for some items but difficult for others. Digital currencies, such as Bitcoin, and online investment accounts are valued based on their current market price or account balance at the time of estate administration. The value of frequent flyer points, loyalty rewards, and gift cards may depend on the terms set by the issuers.

Personal items, like photos and emails, are usually valued for their sentimental worth rather than financial value. Intellectual property, such as websites and digital art, may require expert appraisal based on potential income or marketplace demand. If your estate includes digital businesses, their worth may be based on revenues, website traffic, or online sales history.

Legal Framework for Digital Assets in British Columbia

Digital assets can include everything from social media accounts and email to cryptocurrency and cloud storage. These assets present unique legal challenges when planning for incapacity or death, especially in relation to rules in British Columbia.

BC Estate Law and Digital Assets

In British Columbia, digital assets are usually considered part of your personal property. This means you can include them in your will. However, it is important to clearly list your digital assets and specify who will have access to them after your death.

Privacy laws and the Wills, Estates and Succession Act guide how your digital assets are handled. Your executor or other fiduciary needs legal authority to access these assets, so you should make sure your will and other documents include clear instructions.

Most estate plans now recommend making a separate inventory of your digital assets. This list should include usernames, passwords, and any special access needs. Keeping the list up to date is also important. Failing to do this may result in some assets being lost.

Applicable Federal and Provincial Regulations

Federal and provincial laws impact how digital assets are managed in BC. Privacy laws, terms of service agreements, and data protection rules may stop executors from accessing certain accounts even if they are named in your will.

For example, the Personal Information Protection Act (PIPA) in BC and the federal Personal Information Protection and Electronic Documents Act (PIPEDA) restrict who can access personal information online. These rules may sometimes conflict with what is written in your will.

Major online platforms also have their own agreements about what happens to your account when you pass away. These contracts can override Canadian estate law in some cases. Executors may need to work with these companies, providing extra documents or proof in order to gain access.

Jurisdictional Issues Regarding Digital Accounts

Many digital assets are stored on servers outside of Canada, which causes jurisdictional problems. Different countries have different privacy laws and rules about digital property. This can affect what happens to your social media, email, and other accounts after death.

Terms of service for platforms like Facebook, Google, or Apple may state that only the account holder can access the account. If the provider is based outside of Canada, your executor may have trouble gaining access, even with legal authority from BC.

If you have important digital assets, you should review each provider’s policies to see what happens if you pass away. Creating a clear plan that fits both BC law and terms of service can lower the risk of assets being locked or deleted.

Incorporating Digital Assets into Estate Plans

Digital assets have become a central part of many estates in British Columbia. Planning for these assets ensures your wishes are carried out and helps your executors manage them properly.

Strategies for Including Digital Assets in Wills

Start by making a detailed inventory of your digital assets. Include email accounts, social media, cloud storage, cryptocurrencies, and online business interests. For each asset, note any login information and instructions on how you want them handled after death.

Be clear about which digital assets should be transferred, deleted, or memorialized. List the people you trust to manage each asset. Law firms suggest that your will specifically mention digital assets, as well as physical ones, for full coverage.

Use strong passwords and store them in a secure location, such as a password manager or a sealed envelope in a safety deposit box. Update your inventory as assets change to keep the will accurate.

Trust Structures for Digital Properties

Trusts can hold and manage certain digital properties, especially when you have valuable digital assets. This can include cryptocurrency wallets, domain names, copyright, and online accounts used for business. Placing these items in trust allows you to set out how each asset should be handled, who will benefit from them, and how they are passed on.

A trust can provide ongoing management if beneficiaries are young or inexperienced with digital property. You can appoint a trustee with technical skills to manage these digital holdings according to your instructions. This is often valuable for assets that change value over time, such as digital currency.

Work with a lawyer to draft clear trust instructions and ensure compliance with Canadian law. State the powers and limits of the trustee to minimize confusion and reduce the risk of disputes.

Powers of Attorney for Digital Access

A power of attorney may grant someone access to your digital accounts if you become unable to manage them yourself. This legal document should clearly state what digital assets are included, along with detailed instructions for handling each type.

Choose an attorney who is capable and trustworthy, ideally someone familiar with digital technology. Explain whether they have the right to access, change, transfer, or close accounts.

If you want the attorney to handle passwords or encrypted information, set up a secure method for sharing that information. Regularly review and update your power of attorney to account for new digital assets.

Executor Responsibilities and Access to Digital Assets

As an executor, you must manage the digital assets of the person who has died. Your duties cover technical access, communication with online companies, and accurate recording of your actions.

Obtaining Access to Passwords and Accounts

You may need passwords, security codes, or two-factor authentication to access digital accounts. The law in British Columbia allows you to act on behalf of the estate, but companies may have different rules about sharing account access.

If the person who died left a password manager or written instructions, this can save you time. Always check their will and any separate lists for login details. Without these, you may have to follow each company’s recovery process.

Some accounts, such as social media or cloud services, allow the user to name a legacy contact or grant access after death. Where possible, use these tools to gain entry.

Dealing with Service Providers

Each online service may have its own rules for what executors can do. Some require a copy of the death certificate and proof of your status before they will give you control of an account.

Many companies will not send you passwords but may let you close or memorialize the account. You might fill out request forms online or mail documents. Timelines for responses vary by provider.

Key steps may include:

Reviewing each provider’s policies on deceased user accounts

Preparing documents (ID, death certificate, legal appointment)

Following up with providers if you do not get a timely reply

Record-keeping and Documentation

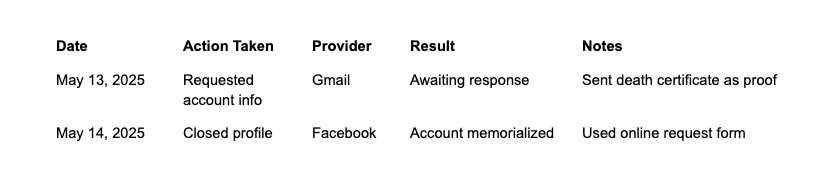

Good records are essential for protecting yourself and the estate. Keep a clear log of every step you take, including attempts to gain access, communications with companies, and any actions within the digital accounts.

A sample record might include:

These logs can help you if questions come up from heirs or from court. Keeping receipts, emails, and letters is also important for any audits. Using digital or physical folders to organize records will help you manage your responsibilities.

Privacy, Security, and Protection of Digital Assets

You must pay close attention to privacy and security when managing digital assets. Breaches can expose personal and financial data, making it important to use strong measures to protect your information and prevent misuse.

Safeguarding Private Information

It is important to use secure methods such as strong passwords and two-factor authentication for all your online accounts. Keep your login details in a safe location and never share them casually. Using a password manager can help you organize and protect your credentials.

List trusted people in your estate documents who can access your digital assets if you become unable to manage them. Make sure legal paperwork, such as a will or power of attorney, includes clear instructions and the necessary permissions for these individuals. In British Columbia, it is important to include a consent clause for privacy legislation so your chosen representative can access digital accounts without breaking privacy laws.

Review your privacy settings on every important online service. Delete old files and accounts you no longer use to limit the risk of leaks.

Preventing Identity Theft and Fraud

Strong digital security measures are necessary to stop criminals from stealing your identity. If someone gains access to your digital assets, they might be able to pretend to be you or to steal money from your bank accounts.

Update your security software often and use firewalls to block unwanted access. Check your accounts routinely for suspicious activity. If you notice something unusual, act quickly by changing your passwords, contacting the provider, and informing your executor or a trusted family member.

It is helpful to keep a list of digital assets, including email accounts, banking, investments, social media, and any encrypted files or virtual property. Document all key details in your estate plan.

Challenges and Disputes in Digital Asset Administration

Legal barriers, privacy rules, and disagreements between beneficiaries can all impact how digital assets are managed after death or incapacity.

Access Barriers and Legal Obstacles

You may encounter significant hurdles when trying to access a loved one’s digital accounts, files, or online investments. Companies like Google or Apple usually require legal documentation before granting any access.

British Columbia law does not always give executors clear powers to handle digital assets. This can create confusion or delays, especially if accounts contain important information or have financial value. Some platforms even permanently lock accounts after death unless you have set up authorizations in advance.

Best practice is to create a list of digital assets, store passwords securely, and provide specific instructions in your will. Consulting a legal professional will help you avoid pitfalls and ensure your wishes are respected. Guidance in estate planning for digital assets is important to reduce access issues.

Conflict Resolution Between Beneficiaries

Disputes often arise when digital assets have not been clearly detailed or divided. Digital photos, social media accounts, and cryptocurrency can all become points of contention. Unequal distribution, hidden assets, or questions about sentimental versus monetary value can lead to disagreements.

To prevent conflict, make your intentions explicit in your estate plan. Communicate with your beneficiaries about your wishes. You may need to update your will as your digital footprint changes over time.

If disagreements do occur, mediation or legal assistance may be needed. Professional advice on resolving disputes around digital assets can help ensure a fair process and respect your wishes. Documenting everything and keeping clear records supports a smoother estate administration.

Resources and Guidance for BC Residents

For practical guidance, consider starting with an inventory of all your digital assets using the checklist provided in this article. List the types of assets, where they are kept, and how they can be accessed. An up-to-date list helps your executor manage your digital property effectively.

Many legal professionals in BC advise granting powers to your executor to access and manage your digital accounts. Without clear instructions, accessing accounts may be difficult or even impossible.

You may find it helpful to review government and professional resources.

Key steps to consider:

List all digital assets with access details.

Review privacy settings on your online accounts.

Name a digital executor if possible.

Store passwords and instructions securely, but separately from your will.

Consult with a lawyer familiar with digital assets and estate law in BC.

By using clear steps and turning to local experts, you can help manage your digital assets and limit complications for your loved ones.

The Final Verdict

Addressing digital assets in your estate plan is essential in today’s technology-driven world. From securing access to online accounts to handling digital currencies and personal files, proper planning helps prevent loss and confusion.

For help incorporating digital assets into your estate plan and ensuring all aspects of your estate are covered, contact the lawyers at Parr Business Law. Our team can guide you through the process with clarity and care, ensuring your digital and traditional assets are fully protected.