Probate Frequently Asked Questions in BC: Essential Information for Executors and Beneficiaries

Probate can be a complex and often misunderstood part of estate administration in British Columbia. Whether you are an executor tasked with managing an estate or a beneficiary seeking clarity on the process, having accurate information is essential.

This article answers some of the most frequently asked questions about probate in BC, including when it is required, how long it takes, what costs are involved, and what steps executors and beneficiaries should expect.

Understanding Probate in British Columbia

Probate in British Columbia is a legal process that confirms if a will is valid and allows for the official distribution of assets. The requirements and steps depend on the type of assets, the value involved, and whether a named executor is in place.

Definition of Probate

Probate is a court-supervised procedure that proves a will is genuine and gives the executor the power to act on behalf of the estate. It is a formal process managed under provincial laws.

In British Columbia, probate confirms the executor’s authority, so banks, financial institutions, and land title offices will accept their instructions. If there is no will, probate can still be required, and a court will appoint someone to manage the estate.

Assets that were jointly owned or had named beneficiaries often do not need probate, but assets held only in the deceased’s name usually do.

Role of the Executor

The executor has the legal duty to carry out the instructions in the will. This includes gathering the deceased’s assets, paying debts, and distributing the estate as directed in the will.

You must apply to the court for probate, prepare and file forms, and give notice to beneficiaries. The executor is responsible for making an inventory of assets, valuing property, and tracking expenses.

Part of your job may include selling property, filing taxes for the person who has died, and ensuring all legal requirements are met. If probate is required, you cannot access or distribute certain assets until the court has granted probate.

When Probate Is Required

Probate is typically needed when the estate includes assets held only in the deceased’s name or when large sums are in financial institutions. In many cases, if the estate’s value exceeds $25,000 or if real estate property is involved, probate is required, no matter the property’s value.

Probate may not be needed if all assets are jointly owned with right of survivorship, or have designated beneficiaries like insurance policies or RRSPs. Some banks and organizations may still insist on probate, even for smaller amounts, to protect themselves.

Each situation is different and depends on the type of assets and the policies of financial institutions or land titles offices involved.

The Probate Application Process

Probate in British Columbia requires several specific steps, each involving important paperwork and careful attention to detail. If you are managing an estate, it is crucial you follow the court’s requirements to avoid delays.

Steps to Apply for Probate

First, you must decide if probate is actually needed for the estate. Some assets may not require probate, depending on how they are owned. If probate is required, you start by locating the original will and the death certificate. You should also conduct a search for a Wills Notice with the BC Vital Statistics Agency.

Next, you fill out the application forms and prepare an inventory of the deceased person's assets and debts. You will need to estimate the value of these assets. Notifying all beneficiaries and interested parties is another key step, usually done using a specific form.

You then submit your completed paperwork to the Supreme Court of British Columbia for processing. The court reviews your application to confirm that all documents are complete and valid.

Where to File Probate Documents

All probate documents in British Columbia must be submitted to the Probate Registry of the Supreme Court. You should bring your paperwork to the registry office in the area where the deceased lived at the time of their death.

Each court registry may have slightly different procedures or office hours, so it is helpful to call ahead or check the specific location’s requirements. You must provide original documents, not photocopies, especially for the will and death certificate.

Once filed, documents are reviewed by court staff. If anything is missing or incorrect, the court may return documents for corrections. Further information about filing locations and requirements is available from the Province of British Columbia’s official probate information.

Common Forms and Documentation

When applying for probate, you will need to complete several forms. The most important forms include the Petition for Grant of Probate (Form P2) and Affidavit of the Applicant (Form P3). A vital document is the original, signed will.

You must prepare a detailed Statement of Assets, Liabilities, and Distribution. The death certificate and, if applicable, the original Wills Notice search results are required. Beneficiary notification forms, like Form P9, ensure all interested parties receive legal notice.

Make sure all forms are signed and organized properly. Missing information or unsigned forms can delay the application process.

Probate Fees and Costs in BC

Probate fees in British Columbia are calculated based on the total value of the estate’s assets. The court also requires specific payments before processing probate, which adds to the total cost.

Calculation of Probate Fees

Probate fees are set by provincial rules and depend on the value of the estate’s assets located in British Columbia.

No probate fee applies if the gross value of the estate is $25,000 or less. If the estate is valued between $25,001 and $50,000, there is a small fee. For estates over $50,000, the main fee is charged at a rate of $14 for every $1,000 or part of $1,000 above $50,000. For example, an estate worth $100,000 would pay $700 in probate fees for the portion over $50,000.

Calculation is based on the gross value of all real and intangible assets, which can include real estate, bank accounts, investments, and personal property. Debts and liabilities are not deducted from this amount. You can review the official fee tables at Probate Fee Act - BC Laws.

Payment of Court Fees

Court fees must be paid before the court will issue a probate grant.

Fees are typically paid by the executor of the will using funds from the estate. Payment is made to the registry of the Supreme Court of British Columbia, usually at the time probate documents are filed. This ensures the court will review and process the application.

The cost includes both a fixed filing fee and the calculated probate fee based on the value of the estate. If the estate is large, the amount due may be significant, so you may need to plan for payment early in the process.

Timeline for Probate

Probate in British Columbia can take several months or even up to a year, depending on the complexity of the estate and how efficiently the paperwork is handled. Some cases are resolved much quicker, while others can face significant delays.

Typical Duration of Probate

For most estates in British Columbia, probate takes between six months and a year. A simple estate with well-organized documents can move faster. In some cases, the court can issue a grant of probate as quickly as six to eight weeks after the application is submitted, especially if there are no disputes or complications.

Most estates take closer to eight to twelve months from the person’s death to the final distribution of assets because there are several steps. These steps include preparing and submitting the application, waiting for the court to review the paperwork, and notifying all interested parties.

Factors Affecting Probate Delays

Several factors can lead to delays in the probate process. The most common reasons include:

Missing or incomplete documentation

Disputes among beneficiaries

Complexity of the estate’s assets (such as businesses or multiple properties)

Court backlogs or registry processing times

Issues with tax filings

If the estate involves complex financial matters or unresolved legal issues, probate can be delayed well past the typical timeline. Delays are also common if any documents are missing or if beneficiaries cannot be easily located.

Contesting a Will During Probate

When a will is challenged during probate in British Columbia, a legal process begins to decide if the will meets the requirements of the law and treats beneficiaries fairly. Specific rules outline who can dispute a will and how the courts decide these cases.

Grounds for Contesting a Will

You may only contest a will in B.C. if you meet certain requirements. Only specific people—like spouses, children, or those with a legal interest in the estate—can dispute a will's validity. Common legal grounds include:

The will-maker lacked mental capacity when signing the will

There was undue influence or pressure on the will-maker

The will does not follow legal rules or formalities

There is evidence of fraud

The will does not provide adequate support to a spouse or child

If you wish to dispute a will, you must act quickly. For example, a wills variation claim must start within 180 days from the date probate is granted in B.C. You should gather all relevant documents and speak to an experienced estate lawyer before taking action.

Role of the Court in Disputes

Courts in B.C. are responsible for settling will disputes and deciding if the will is valid. The judge looks at all the evidence, including medical records, witness statements, and the will-maker’s intentions. The court will also see if the will meets all legal requirements, like proper signing and witnessing.

If a challenge is based on fairness, such as a claim by a spouse or child for more support, the court may change the will’s terms. The main goal is to ensure the will-maker’s wishes are honoured, as long as these wishes are legal and reasonable.

It is important to present clear, organized evidence and to follow all deadlines set by the court. Legal advice can help you understand what is needed for a successful dispute.

Probate and Jointly Owned Assets

When you own property jointly with someone else, the rules about probate can be different compared to assets held in your name alone. In British Columbia, the type of ownership shapes what happens when one owner dies.

Types of Joint Ownership:

Joint Tenancy: Most common between spouses or close family members. When one person dies, the asset typically goes directly to the surviving owner. Probate is often not required for assets held in joint tenancy.

Tenancy in Common: Each owner has a separate share. When one owner dies, their share does not pass automatically to the other owner—it becomes part of their estate, and probate may be required.

Examples of jointly owned assets include:

Bank accounts

Houses or condos

Investment accounts

Assets held in joint tenancy usually pass directly to the survivor without the need for probate or probate fees in B.C.

Note: Rules can be different if there are disputes or concerns about true ownership. Always check the legal details of your specific situation if you have questions.

Probate Exemptions in British Columbia

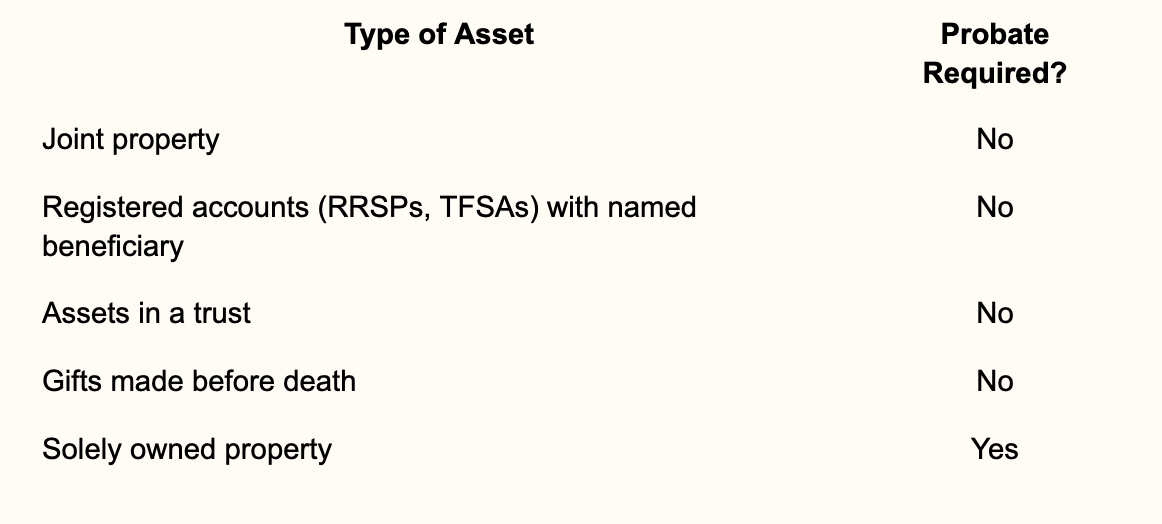

Not all assets in British Columbia must go through probate. Certain items may be exempt, depending on their ownership and structure.

Assets commonly exempt from probate include:

Jointly owned property with right of survivorship

Assets with named beneficiaries, such as life insurance policies or RRSPs

Assets held in a trust

Gifts made before death

If you co-own property, it may pass directly to the other owner outside of probate. For example, if you own a home with someone else as joint tenants, it usually does not require probate.

Some accounts or investments allow you to name a beneficiary. These assets are transferred directly to the beneficiary and are not included in the probate process.

Small estates under a certain value might not need probate. In British Columbia, if the estate is valued below $25,000, you might not have to apply for probate, but you should confirm with each financial institution.

Duties and Liabilities of an Executor

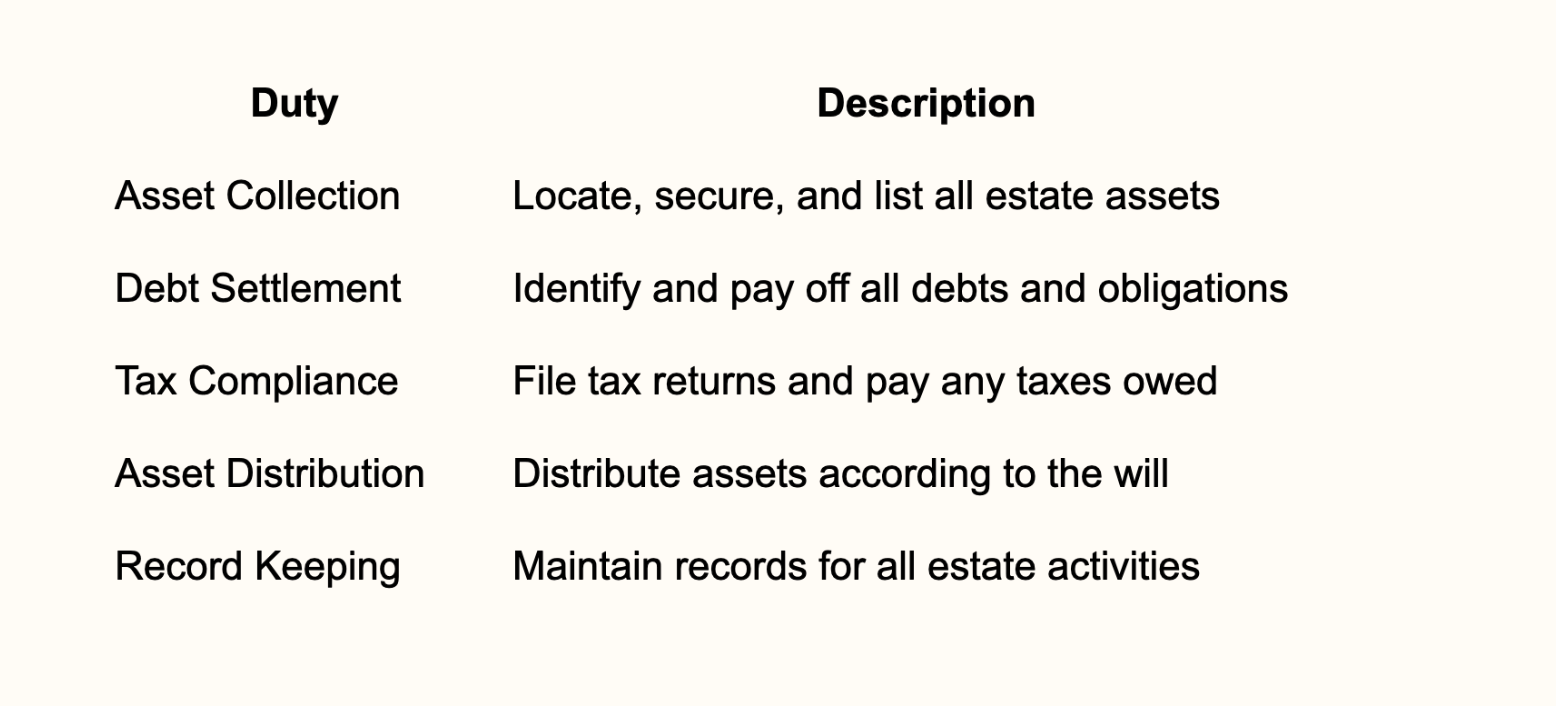

As an executor, you are responsible for handling the estate of the deceased. Your main tasks include gathering assets, paying debts, filing taxes, and distributing property to beneficiaries. You must follow the will’s instructions and comply with provincial laws.

Key Duties of an Executor

Gather all estate assets, such as property, bank accounts, and investments

Prepare an inventory and valuation of assets and debts

Pay outstanding bills and settle debts

File any required tax returns and pay taxes owed

Distribute remaining assets to beneficiaries as stated in the will

Keep accurate records of all transactions

A simple table outlining these responsibilities:

You have a legal duty, called a fiduciary duty, to act in the best interest of the estate and the beneficiaries. If you fail to carry out your duties properly or act in bad faith, you can be held personally liable for losses or mistakes.

Sometimes, dealing with the estate may require getting legal or financial advice. If tasks are not completed correctly, you may be responsible for any financial loss or damage done to the estate. If you do not want to or cannot act as executor, you can refuse this role.

Probate and Estate Administration Taxation

When you handle an estate in British Columbia, you need to be aware of several taxes and fees. The most common is the probate fee, which is required before assets can be distributed.

In British Columbia, probate fees are based on the value of the estate. The current probate fee is roughly 1.4% of the estate's gross value over $25,000. Estates worth less than $25,000 are usually not charged probate fees.

You may also need to address other taxes during estate administration. Income earned by the estate after death is taxed, and the estate must file a final tax return for the deceased. This includes income from employment, pensions, or investments up until the date of death.

Common items to remember:

File the final personal tax return for the deceased.

Pay taxes on income earned by the estate after death.

Settle any outstanding taxes before distributing assets.

If you are unsure about tax responsibilities, consider speaking with a tax professional or estate lawyer.

Dealing With Intestate Estates

When someone passes away without a will in British Columbia, they are considered to have died “intestate.” This means there are no instructions left for how to distribute their estate.

An intestate estate is managed according to the Wills, Estates and Succession Act (WESA). The law decides who has the right to apply to be the estate administrator, and how assets will be divided. You cannot choose your own beneficiaries.

Common steps involved:

Determine if there is a will.

If not, apply to the court for a grant of administration.

Identify and value the estate’s assets and debts.

Distribute the estate according to WESA.

The following table shows how assets may be divided:

If you are dealing with an intestate estate, you may need to consult a lawyer. You can read more about what happens when there is no will under BC law by visiting this government resource on wills and estates.

Probate Records and Public Access

Probate records are official documents filed with the court when a will goes through the probate process in British Columbia. These records confirm the legal status of a will and the authority of the executor.

You can look up current probate files across the province using Court Services Online. This online tool allows you to search for information about probate applications and cases.

However, it is important to note that the wills themselves are not available online. Only certain documents, such as the probate application and court orders, may be accessible through this service. If you need a physical copy of a will or full probate file, you must contact the court registry.

Common types of probate records you can access:

You may also check if a probate file has been opened for a specific will by doing an E-Search on Court Services Online. This can help you find basic details before requesting physical documents.

Public access to probate records is allowed, but some personal information might be restricted to protect privacy. Always follow court guidelines when requesting or viewing these documents.

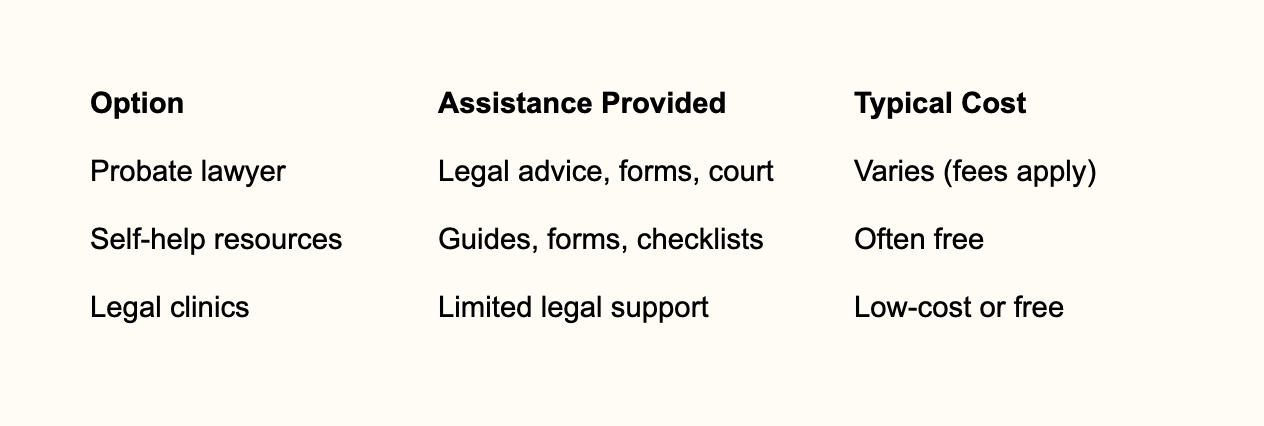

Legal Assistance and Resources for Probate

Legal assistance is often helpful when dealing with probate in British Columbia. You can hire a probate lawyer to guide you through the process, help fill out forms, and answer legal questions. This can reduce errors and delays.

If you wish to handle probate on your own, you can find detailed instructions and forms on the B.C. government website. There are also online guides and resources that explain each stage of the probate process.

Some common resources include:

Government of British Columbia probate forms

MyLawBC for step-by-step help

Local courthouse or legal clinics

You may also want to consider speaking with a financial advisor or accountant, especially if the estate is large or complex.

Probate lawyers usually charge a flat fee or an hourly rate. In British Columbia, probate fees are calculated based on the value of the estate.

Below is a simple comparison:

You can choose the option best suited to your needs and budget.

Digital Property and Probate in BC

When handling an estate in British Columbia, you may need to consider digital property. Digital property includes accounts, files, and assets stored online or on electronic devices. These can involve social media accounts, emails, digital photos, and online banking.

What counts as digital property?

Email accounts

Social media profiles

Cloud storage (Google Drive, iCloud)

Online financial accounts

Loyalty and reward accounts

If you are an executor, you may have to collect and manage digital property during probate. You often need passwords or special access to these accounts. In some cases, companies have their own rules for what happens to accounts after the owner dies.

Probate is required in BC if the digital asset has a significant monetary value or is in the deceased's name only. Financial institutions may request a probated will before sharing access.

Consider making a list of digital properties and passwords in your records. This can help your executor carry out your wishes and manage important accounts.

Below is a simple table to show examples:

Effect of Probate on Real Estate Transfers

When you are handling an estate in British Columbia, probate can affect how real estate is transferred. Probate is a legal process that confirms a will is valid and gives you the authority to manage the estate.

If the deceased owned real estate in their name alone, you will usually need probate before you can transfer or sell the property. This means you cannot change the title or sell the property until the court grants probate.

Jointly owned real estate with rights of survivorship usually passes directly to the surviving owner, without needing probate. For example, if you owned a home with your spouse as joint tenants, it may automatically go to the surviving joint owner.

Probate may also affect the time it takes to transfer real estate. Properties that require probate can take several months to transfer, depending on the court’s schedule and the estate’s complexity.

Key points:

Probate is usually required to transfer real estate held in the deceased’s name alone.

Jointly owned real estate with rights of survivorship often transfers outside of probate.

Delays are common because the property cannot be transferred until probate is granted.

Legal and accounting fees, probate fees, and unpaid debts may need to be settled before you can transfer the property’s ownership.

The Final Verdict

Understanding the probate process in BC is essential for both executors and beneficiaries to ensure the estate is administered properly and in accordance with the law. By becoming familiar with common questions and challenges, you can avoid delays and reduce stress during a difficult time.

For professional guidance on any aspect of probate or estate administration, contact the attorneys at Parr Business Law. Our knowledgeable team is here to support you with clear advice and effective legal solutions.