Choosing Executors, Attorneys, and Guardians in BC: Key Considerations for Estate Planning

Selecting the right executors, attorneys, and guardians is a fundamental part of effective estate planning in British Columbia.

These individuals will be responsible for managing your estate, making decisions on your behalf if you're incapacitated, and caring for your minor children. Choosing the right people for these roles requires careful thought about their reliability, availability, and ability to act in your best interests.

This article outlines the key considerations for making these important appointments to help you create a comprehensive and secure estate plan.

Overview of Executors, Attorneys, and Guardians in BC

Choosing an executor, attorney, or guardian can affect how your affairs are managed during your lifetime and after your death. Each role has specific powers, duties, and legal requirements under British Columbia law.

Legal Distinctions Between Roles

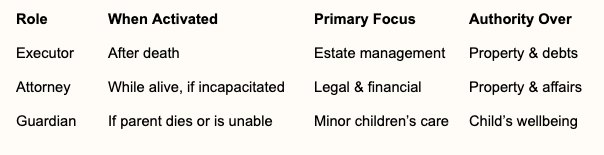

An executor is named in a will to handle your estate after you die. An attorney is appointed by you in a power of attorney document to manage your financial and legal matters if you are alive but unable to act. A guardian is selected to care for your minor children if you die or cannot look after them.

These roles do not overlap. For example, an attorney's legal power ends at death, at which point the executor steps in. A guardian only makes decisions about a child’s welfare, and does not have control over your assets unless stated in a trust or will.

Below is a comparison table:

Relevant BC Legislation

The role of executor is defined under the Wills, Estates and Succession Act. The Power of Attorney Act sets the rules for appointing and acting as an attorney. Guardianship is mainly covered in the Family Law Act.

When you appoint someone, you must use the correct legal form and follow BC requirements. For estate matters, you may need to go through probate and estate administration in the Supreme Court of British Columbia.

Each law explains what your chosen person can and cannot do, how they should report to the court or government, and what happens if a chosen person is unable or unwilling to serve.

Key Responsibilities and Duties

Executors must collect the deceased’s assets, pay debts, file taxes, and distribute items according to the will. Legal advice might be needed during probate, especially for complex estates.

Attorneys can access financial accounts, pay bills, and manage property for you, but must act in your best interest and keep detailed records. They cannot change your will or make health care choices; those require specific forms.

Guardians are responsible for the day-to-day care of children. They make decisions about schooling, health, and living arrangements. If there is no named guardian, the court may appoint one based on the child’s best interests, which can be overseen by the Public Guardian and Trustee of BC.

Choosing an Executor in BC

Selecting an executor is a vital part of preparing a will in British Columbia. This choice affects how your estate is managed, how your wishes are carried out, and how smoothly the probate process goes.

Criteria for Selecting an Executor

In BC, you can choose almost any adult to act as your executor. It can be a family member, a close friend, a beneficiary, or even a professional like a lawyer. The person must be at least 19 years old and mentally competent at the time of appointment.

Your executor should be someone who is responsible, organized, and trustworthy. Since settling an estate can take months or even years, geographic location also matters for convenience and practicality.

It is important that your chosen executor can handle paperwork, communicate well with beneficiaries, and make difficult decisions when needed. The executor may have to deal with banks, lawyers, and government agencies, so basic financial knowledge is helpful. If you cannot identify a suitable person, the Public Guardian and Trustee may accept this role in specific cases.

Executor’s Powers and Obligations

An executor’s main responsibility is to carry out the instructions in your will and manage your estate. This includes securing property, paying off debts, filing taxes, and distributing gifts as you directed. They may also need to handle funeral arrangements and maintain assets until the estate is settled.

Executors must always act in the best interests of the beneficiaries and follow both your will and relevant BC laws. A key duty is the “duty to account,” which requires careful records of all financial transactions and decisions made for the estate.

If there is more than one executor, they must work together to make decisions for the estate. Executors have authority granted by the will, but sometimes they must seek court approval for certain actions, especially if legal disputes arise with beneficiaries or creditors.

Potential Challenges for Executors

Taking on the role of executor can be stressful and time-consuming. Common challenges include handling difficult beneficiaries, complex assets, or disagreements among family members.

There may be emotional stress if the executor is also grieving. Mistakes in managing taxes or debts can lead to legal and financial problems. Executors could even be held personally responsible for certain errors or losses.

If the executor cannot complete their duties because of health, distance, or other issues, delays and complications can happen. Understanding possible challenges in advance will help you choose someone prepared for these obligations.

Alternate and Co-Executors

It is often wise to name an alternate executor in case your first choice cannot serve. If your main executor is unable or unwilling to act, the alternate steps in to ensure your estate is managed without court delays.

Some people choose more than one executor, known as co-executors. This arrangement can help share the workload and decisions, provide extra oversight, and balance skills or family interests. Co-executors must cooperate, make joint decisions, and keep clear records.

You should talk with your chosen executors to make sure they are willing and able to take on the role. Consider practical issues, like whether co-executors live in different provinces, which could affect how easily they can work together to settle your estate.

Appointing an Attorney for Power of Attorney

Selecting an attorney for power of attorney in British Columbia is a legal process that lets you choose someone you trust to manage your financial or legal affairs if you cannot do so yourself. It is important to understand the types of power of attorney available, what to look for in an attorney, the legal responsibilities involved, and how to manage risks.

Types of Power of Attorney in BC

There are two main types of power of attorney in British Columbia: general and enduring.

A general power of attorney gives your chosen person broad authority over your financial and legal affairs but becomes invalid if you lose mental capacity. An enduring power of attorney stays valid if you become incapable due to illness or injury. You must be capable when you create either type.

In BC, you can also choose between appointing one attorney or more than one. If more than one person acts as your attorney, you can say whether they must act together or separately. Details about these types and forms are outlined in the Power of Attorney Act.

Qualities to Consider in an Attorney

Choosing an attorney should not be rushed. The person you appoint must be at least 19 years old in BC, which is the age of majority.

Trustworthiness is one of the most important qualities. This person will have access to your bank accounts, property, or other assets. Consider their decision-making skills, sense of responsibility, and ability to stay organized under pressure.

Geography matters too. It may be easier if your attorney lives nearby, making it simpler for them to handle tasks like banking or meetings. Good communication skills are also important so your wishes are understood and respected.

Duties and Limitations of an Attorney

An attorney under a power of attorney document has legal responsibilities. They must always act in your best interests and manage your property with care, honesty, and loyalty. Their authority is set by the limits you put in the document.

Attorneys cannot make decisions about your health care or personal care unless they are appointed under a different legal document. They must keep your finances separate from their own and cannot benefit personally from your money or property unless you have said they can. The law requires careful records of all transactions to prevent errors or misuse.

Risks and Safeguards

There are risks in appointing an attorney. An attorney has access to your finances and property, so there is opportunity for misuse or fraud. It’s important to choose someone you fully trust.

To reduce risks, you can:

Appoint more than one attorney with joint authority

Require regular reporting to a third party

Limit the powers given in the document

Ask for updates or statements about account activity

For those who want extra protection, the Public Guardian and Trustee of BC can offer oversight and resources. Always review your power of attorney documents regularly to keep them up to date and meet your needs.

Selecting a Guardian for Minor Children

Appointing a guardian for your minor children can help ensure their care and security if you are unable to look after them. The process involves meeting legal requirements, careful consideration of candidates, and following required steps set by British Columbia law.

Legal Criteria for Guardianship

In British Columbia, a guardian is someone legally responsible for a child's care and upbringing. The law sets out who can become a guardian and under which situations.

Generally, the child’s parents are considered the default guardians. If you want someone else to step in, you may appoint a guardian in your will, as long as the person is at least 19 years old and willing to take on the responsibility.

A non-parent guardian may need to seek a court order to be legally recognized. In unique cases, the Public Guardian and Trustee may also play a role, especially if no private guardian is available.

Considerations for Choosing a Guardian

When choosing a guardian, take into account the person's relationship with your child and their parenting values. Consider their age, health, lifestyle, and willingness to serve as a guardian.

It is important to discuss your choice with the potential guardian ahead of time. Make sure they agree to accept the role and understand the duties it involves, including daily care, education, and any cultural or religious needs.

You may want to choose an alternate guardian in case your first choice is unable or unwilling. These discussions should happen before you write them into your will, as experts recommend talking to your chosen guardian first.

Procedures for Appointing Guardians in BC

You can name a guardian for your children under 19 in your will. This helps ensure the appointment has legal force if you pass away or cannot care for your children.

To do this, you must clearly state the intended guardian’s name and your intentions in your will. It's wise to work with a lawyer to avoid mistakes that could affect your wishes. Updating your will is also necessary if your circumstances change or your preferred guardian is no longer suitable.

If a guardian is not named in your will, or is unable to act, others may apply to the court to become your child's guardian. In some cases, the Public Guardian and Trustee of BC may be involved to protect your child’s interests.

Conflicts of Interest and Dispute Resolution

Conflicts can arise when personal interests interfere with duties to an estate, or when multiple appointees have trouble working together. If these issues are not handled promptly, they may harm the estate or delay important decisions.

Identifying Conflicts Among Appointees

A conflict of interest occurs when an executor, attorney, or guardian stands to benefit personally in a way that clashes with their responsibilities. For example, if an executor is also a beneficiary and makes decisions that favour themselves, this is a conflict.

It is important to watch for signs like bias in decision-making, withholding information, or delays in carrying out tasks. Family relationships, business connections, or financial interests can also create concerns.

If you believe a conflict exists, you can ask an estate lawyer to review the situation. In British Columbia, a serious conflict of interest may be grounds to remove an appointee if it affects their ability to act fairly.

Mediation and Legal Remedies

When conflicts among appointees cannot be resolved informally, mediation is often a first step. Mediation is a process where a neutral third party helps everyone reach an agreement outside of court.

If mediation fails, you may need to seek legal remedies. This could include asking the court to remove or replace an executor or attorney. In British Columbia, removal is possible if a conflict of interest seriously threatens the proper administration of the estate.

Court action may also address issues like withheld information or improper financial decisions. Each situation should be reviewed carefully to protect the interests of all parties involved.

Review and Update of Appointments

Keeping your choices for executors, attorneys, and guardians up to date is essential. Regularly reviewing these appointments helps protect your interests and those of your loved ones.

Timing for Review

You should review your appointments whenever there is a major change in your life or the lives of your chosen individuals. Common triggers include marriage, separation, divorce, or the birth of a child. Changes in health, relocations, or significant shifts in relationships also make it necessary to reassess your selections.

It is recommended to check your will and related documents at least every three to five years. This ensures that the people you have chosen are still able and willing to act in your best interests. If an executor, attorney, or guardian passes away or is no longer suitable, you need to update your documents right away.

Keeping a regular schedule reduces the risk of legal complications that can happen if the selected person is no longer a good fit. This habit protects both your estate and your intentions for your family.

Process for Making Changes

When you need to make changes, you must follow the proper legal steps. For wills, you can update by making a new will or by adding a codicil, which is an official amendment. For powers of attorney or guardianship, you revoke the previous appointment and create a new document.

It is important to sign these documents before witnesses as required by B.C. law. Your changes do not take effect until you meet the formal requirements. Guidance from a lawyer ensures your wishes are clear and legally valid.

Be sure to inform your new appointees so they understand their responsibilities. It is also wise to let family members know about the changes to avoid future disputes.

Legal Assistance and Professional Advice

When you are making decisions about executors, attorneys, and guardians, it is important to seek professional legal advice. This helps you ensure all documents meet legal requirements in British Columbia.

You can write your own will using a kit, but getting help from a lawyer or notary public makes it more likely your wishes will be carried out as you intend. A professional can review your documents and answer questions about your estate plan.

When dealing with complex estates, disputes, or blended families, a lawyer’s advice is especially useful. Professionals can also help you choose someone who is best suited to be your executor or attorney. If you do not have someone you trust, you may be able to name the Public Guardian and Trustee (PGT) as your executor.

Reasons to consult a professional:

Properly draft and witness wills and powers of attorney

Understand legal rights and responsibilities

Address complicated family or financial situations

Ensure legal validity across all documents

Having professional advice gives you peace of mind that your estate planning meets provincial laws and standards. A qualified advisor will help you avoid errors that could cause problems later on.

The Final Verdict

Choosing the right executors, attorneys, and guardians is critical to ensuring your estate is managed according to your wishes and your loved ones are well protected.

These decisions should be made thoughtfully, with consideration given to each individual’s capabilities and trustworthiness.

For guidance in making these important choices and drafting legally sound estate planning documents, contact the lawyers at Parr Business Law. Our team is here to help you build a plan that provides clarity, security, and peace of mind.