RRSP Beneficiary Designation and Tax Implications Explained

Registered Retirement Savings Plans (RRSPs) are an essential component of many Canadians’ financial and estate plans. However, understanding how RRSP beneficiary designations work - and the potential tax implications - is crucial to ensuring your savings are transferred efficiently. The way your RRSP is treated after your death depends largely on who you designate as your beneficiary.

This article explains the key rules governing RRSP beneficiary designations, outlines potential tax consequences, and provides practical guidance for integrating your RRSP into your overall estate plan.

Understanding RRSP Beneficiaries

When you name a beneficiary for your Registered Retirement Savings Plan (RRSP), you decide who will receive the funds after your death. This choice affects how the money is transferred, how taxes apply, and whether the funds pass through your estate or go directly to the person you choose.

Definition of an RRSP Beneficiary

An RRSP beneficiary is the person or entity you designate to receive the plan’s assets when you die. You can name this person directly in your RRSP contract or through your will, as explained by the Canada Revenue Agency.

If no beneficiary is named, the RRSP’s value becomes part of your estate and may be subject to probate fees and delays. Naming a beneficiary can help the funds bypass the estate, allowing faster and simpler distribution.

You may also name more than one beneficiary and assign specific percentages to each. This flexibility allows you to divide your RRSP according to your wishes while controlling how the funds are handled after death.

Types of RRSP Beneficiaries

There are two main types of RRSP beneficiaries: qualified and non-qualified.

A qualified beneficiary includes a spouse, common-law partner, financially dependent child, or grandchild. A qualified beneficiary may transfer the funds to their own RRSP or RRIF without immediate tax consequences. This allows tax deferral until withdrawal.

Non-qualified beneficiaries, such as adult children or other relatives, receive the funds after the estate pays taxes on the RRSP’s value. The entire amount is included as income on your final tax return. This can significantly reduce the amount the beneficiary ultimately receives.

To ensure your designations remain accurate, review them regularly, especially after major life changes like marriage, divorce, or the birth of a child.

Role of an RRSP Beneficiary

The RRSP beneficiary’s main role is to receive the proceeds of your plan after your death. Depending on the relationship, the beneficiary may have tax obligations or options for rolling over the funds.

A spouse or common-law partner can transfer the RRSP balance to their own plan tax-free. This helps maintain the tax-deferred status of the savings.

If the beneficiary is not a qualified person, the estate typically pays the taxes before distributing the remaining funds. The beneficiary then receives the after-tax amount directly, avoiding the probate process if named on the account.

By naming a beneficiary correctly, you control how your RRSP is handled, reduce potential estate costs, and simplify the process for your loved ones.

Designating an RRSP Beneficiary

You can decide who will receive the funds in your Registered Retirement Savings Plan (RRSP) after your death. This choice affects how taxes are handled and how quickly your savings transfer to the intended person. Proper documentation ensures your wishes are legally valid and carried out as planned.

How to Name a Beneficiary

You can name a beneficiary directly in your RRSP contract or in your will. Most financial institutions provide a beneficiary designation form that you must complete and sign. The designation can include one or more individuals, such as your spouse, children, or another person.

In some provinces, you can also name a charity or organization as a beneficiary. If you live in Ontario, for example, you can designate beneficiaries for registered accounts like RRSPs, RRIFs, and TFSAs under the Succession Law Reform Act. This allows the funds to pass directly to the named person or entity, bypassing the estate and avoiding estate administration tax.

Keep a copy of your completed form and confirm that your financial institution has recorded the designation correctly. Review your account statements periodically to ensure the information remains accurate.

Legal Requirements for Designation

To make a valid designation, you must be the RRSP account holder and of legal age to sign financial documents. The designation must be in writing, signed, and dated. If you complete a form through your financial institution, it becomes part of your RRSP contract.

If you name your spouse or common-law partner as the beneficiary, the funds can transfer to their own registered plan without immediate tax. This tax deferral applies only if the person qualifies under the Canada Revenue Agency’s rules. Otherwise, the RRSP amount is included in your final tax return.

Designations made in a will must clearly identify the RRSP and the intended beneficiary. If both your RRSP contract and will name different beneficiaries, the designation in the RRSP contract usually takes priority.

Changing or Revoking a Beneficiary

You can change or revoke your RRSP beneficiary at any time, as long as you remain mentally capable. To make a change, complete a new designation form with your financial institution or update your will. The most recent valid document overrides previous ones.

Life events such as marriage, divorce, or the birth of a child often require updates. Regular reviews prevent unintended outcomes, such as an ex-spouse receiving funds.

If no beneficiary is named, or if the named person dies before you, the funds become part of your estate. In that case, the proceeds may be subject to probate and estate administration tax, which can delay payment to your heirs. Keeping your designations current ensures your RRSP transfers as you intend.

Implications of Naming a Spouse or Common-Law Partner

When you name your spouse or common-law partner as the beneficiary of your Registered Retirement Savings Plan (RRSP), you can reduce immediate tax costs and simplify estate administration. This designation often allows the plan’s value to transfer directly to your partner without going through probate, preserving more of your savings.

Tax-Deferred Transfers

If you name your spouse or common-law partner as your RRSP beneficiary, the plan’s assets can move to their RRSP or RRIF on a tax-deferred basis. This means no income tax is charged at the time of transfer. Instead, your partner pays tax only when they withdraw funds later.

This rollover can prevent the RRSP balance from being taxed as income on your final return. This approach can help avoid estate delays and probate fees. It also maintains the tax-sheltered status of the funds, allowing continued growth.

If your spouse or partner does not meet the eligibility requirements, the RRSP value becomes taxable to your estate in the year of death. To ensure the deferral applies, you must clearly name your spouse or partner as the beneficiary on the RRSP contract, not just in your will.

Spousal Rollovers

A spousal rollover allows your RRSP to transfer directly to your spouse’s registered account when you die. This process is recognized by the Canada Revenue Agency and can occur automatically if your beneficiary designation is properly set up.

A rollover lets your spouse add the funds to their own RRSP or RRIF without triggering immediate tax. They continue to manage and withdraw the funds under their own tax rate and timeline.

This option can be particularly useful for couples planning retirement income together. It ensures your savings remain protected and continue to grow tax-sheltered until your spouse begins withdrawals. Proper documentation and clear beneficiary designations are essential to ensure the rollover is accepted by the financial institution and the CRA.

Non-Spouse Beneficiaries

When a non-spouse inherits a Registered Retirement Savings Plan (RRSP), the tax treatment differs from that of a surviving spouse. The plan’s value becomes taxable to the deceased’s estate, and the beneficiary receives the remaining funds after taxes are paid. In some cases, special rules apply if the beneficiary is a financially dependent child or grandchild.

Tax Consequences for Non-Spouse Beneficiaries

You cannot transfer an RRSP tax-free to a non-spouse. The fair market value of the RRSP is included in the deceased person’s final tax return as income. This means the estate, not the beneficiary, is responsible for paying any taxes owed. The beneficiary then receives the remaining balance tax-free.

For example, if an RRSP is worth $80,000, that amount is added to the deceased’s income for the year of death. Depending on total income, this could move the estate into a higher tax bracket. The Canada Revenue Agency requires the RRSP issuer to determine the correct beneficiary designation before releasing funds, as explained by Canada.ca.

Minor Children and RRSP Inheritance

If your child or grandchild inherits your RRSP and was financially dependent on you, special tax rules can apply. The proceeds may be rolled into an income annuity that pays the child until age 18. This allows income to be spread out and taxed at the child’s lower rate.

When the child is not financially dependent, the inheritance is treated like any other non-spouse transfer. The RRSP’s full value is taxed in the deceased’s final return, and the child receives the after-tax amount.

The TurboTax Canada guide explains that these rules help reduce the immediate tax burden on estates supporting minors. You should confirm eligibility with a tax professional to ensure the correct treatment under the Income Tax Act.

Tax Considerations for RRSP Beneficiaries

You may face different tax outcomes depending on who you are in relation to the deceased and how the RRSP funds are handled. The Canada Revenue Agency (CRA) treats an RRSP differently when transferred to a spouse or dependent compared to when it goes to other beneficiaries.

Taxation Upon Death of Account Holder

When an RRSP holder dies, the CRA generally treats the full value of the plan as income on the deceased’s final tax return. This means the estate must pay tax on the fair market value of the RRSP as if the funds were withdrawn immediately before death.

However, if you are a spouse, common-law partner, or financially dependent child or grandchild, the tax may be deferred. You can transfer the RRSP to your own RRSP, RRIF, or eligible annuity without immediate tax. The tax is then paid later when you withdraw the funds.

If you are not a qualified beneficiary, the RRSP amount is fully taxable on the deceased’s final return before any inheritance is distributed. The CRA explains how this process works in detail in its guidance on amounts paid from an RRSP or RRIF upon the death of an annuitant.

Reporting RRSP Income

If you receive RRSP funds as a qualified beneficiary, you must report the amount as income when you withdraw it. You can defer tax by transferring the payment directly to another registered plan, such as an RRSP or RRIF, under a refund of premiums arrangement.

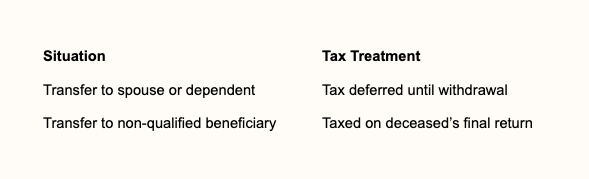

Here’s a simple breakdown:

You can learn more about how the CRA taxes RRSPs at death through reliable resources like TurboTax Canada and Canada Life.

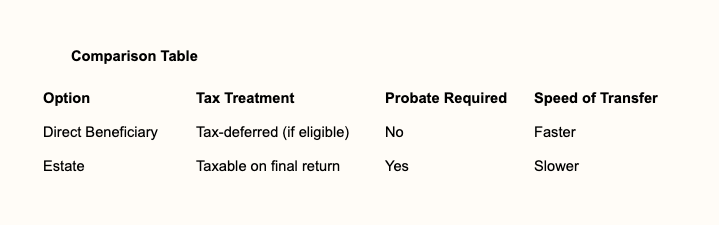

RRSP Beneficiary vs. Estate

When you die, your Registered Retirement Savings Plan (RRSP) can either pay directly to a named beneficiary or become part of your estate. The choice affects how taxes are handled, how quickly funds are transferred, and whether probate fees apply.

Differences Between Direct Beneficiary and Estate

When you name a direct beneficiary, such as a spouse, common-law partner, or dependent, the RRSP funds transfer directly to them. This transfer often qualifies for a tax-deferred rollover, meaning the money moves into their RRSP or RRIF and is only taxed when withdrawn later. This process avoids delays and simplifies administration.

If your RRSP goes to your estate, the plan’s value becomes taxable on your final return. The estate then distributes what remains after taxes and fees. This option may make sense if you want to divide assets among several heirs or manage complex estate instructions.

The RRSP issuer must confirm who the beneficiary is before releasing funds. Keeping your designation current ensures your intentions are clear and helps avoid disputes or delays.

Probate Implications

Naming a beneficiary allows the RRSP to bypass probate, which saves time and reduces costs. This direct transfer avoids probate fees, since the funds do not pass through the estate. This can preserve more of the plan’s value for your beneficiary.

If your RRSP forms part of your estate, probate applies. The executor must obtain court approval before distributing assets, which can take months. Probate fees vary by province and are based on the estate’s total value.

Regularly reviewing your RRSP designation helps ensure your estate plan remains efficient and aligned with your goals.

Special Circumstances and Exceptions

Certain situations allow you to handle your RRSP differently than the standard beneficiary rules. These include cases involving disability savings transfers and situations where creditor protection may apply during bankruptcy. Understanding these exceptions helps you protect your assets and plan your estate more effectively.

Registered Disability Savings Plan Transfers

If your beneficiary is financially dependent due to a physical or mental disability, you may be able to transfer RRSP funds to a Registered Disability Savings Plan (RDSP) on a tax-deferred basis. This option helps preserve the funds for long-term care and support.

According to the Canada Revenue Agency, the transfer must occur to an RDSP for a qualifying dependent child or grandchild. The funds are not immediately taxed when transferred, but they will be taxable when withdrawn from the RDSP.

To qualify, the dependent must have been financially reliant on you at the time of death. You or your estate representative must complete the transfer within the time limits set by the CRA. This rule ensures that the funds continue to benefit the dependent while maintaining tax efficiency.

Bankruptcy and Creditor Protection

RRSPs generally receive creditor protection under federal and provincial laws, but the level of protection depends on how and where the plan is held. For example, RRSPs purchased through insurance companies are typically protected under the Insurance Act, while other RRSPs may rely on provincial exemptions.

In a bankruptcy, contributions made within the 12 months before filing may not be protected. Funds contributed earlier are usually exempt from seizure. This rule discourages last-minute deposits meant to shield assets from creditors.

Designating a direct beneficiary can also help your RRSP bypass probate and remain protected from estate creditors. However, the protection depends on your province’s legislation and the type of account. Always confirm your plan’s coverage before assuming full protection.

Common Mistakes When Naming RRSP Beneficiaries

You may overlook important details when naming a beneficiary for your Registered Retirement Savings Plan (RRSP). Small errors can lead to tax issues, delays, or unintended outcomes for your estate.

1. Naming the wrong person or entity

Many people automatically list a spouse or child without considering the financial or tax impact. In some cases, naming your estate as the beneficiary may be more practical, especially if you want to ensure taxes are paid from RRSP proceeds rather than other assets.

2. Failing to update designations

You should review your designations after major life events such as marriage, divorce, or the birth of a child. Outdated designations can cause disputes or direct funds to the wrong person.

3. Ignoring tax implications

If you name someone other than your spouse or a financially dependent child or grandchild, the full value of your RRSP becomes taxable in your final return. Naming a spouse allows for a tax-deferred rollover to their RRSP or RRIF.

4. Not considering multiple beneficiaries

You can name more than one beneficiary, but you must clearly state the percentage each person receives. Ambiguous instructions may cause confusion or legal challenges.

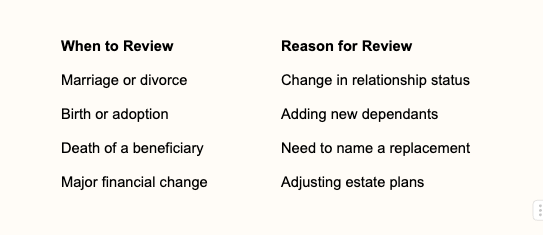

Reviewing and Updating Beneficiary Designations

You should review your RRSP beneficiary designation regularly to ensure it still reflects your wishes. Life events such as marriage, divorce, or the birth of a child may require a change. Keeping your information current helps prevent confusion and ensures your assets go to the intended person.

If you have converted your RRSP to a RRIF, confirm that your beneficiary information has also been updated. Financial institutions recommend verifying that both you and the bank hold copies of the most recent designation to avoid disputes.

Steps to review your designation:

Check your RRSP or RRIF contract for the current beneficiary name.

Compare it with your will to ensure consistency.

Update the designation form if your circumstances have changed.

Request written confirmation from your financial institution.

You can designate a beneficiary directly on your RRSP contract or through your will. Each method carries different legal and tax implications.

Regular reviews help you maintain control over how your RRSP funds are distributed.

The Final Verdict

Properly designating an RRSP beneficiary is vital to minimizing taxes and ensuring your retirement savings are distributed according to your wishes. The tax treatment of your RRSP can vary significantly depending on the beneficiary’s relationship to you and how the funds are transferred.

For expert advice on structuring RRSP beneficiary designations and aligning them with your estate planning goals, contact the attorneys at Parr Business Law. Our team can help you make informed decisions that protect both your assets and your beneficiaries.