Estate Planning for Blended Families in BC: Key Considerations and Legal Strategies

Estate planning for blended families in British Columbia involves unique challenges that require careful attention to family dynamics and legal rights.

Whether dealing with stepchildren, multiple marriages, or shared and separate assets, it’s important to create a plan that balances fairness with your intentions. Without a properly structured estate plan, disputes can arise, and certain family members may be unintentionally excluded.

This article outlines key considerations and legal strategies to help blended families in BC protect their interests and ensure clarity in the distribution of their estate.

Fundamentals of Estate Planning for Blended Families

Estate planning for blended families in British Columbia can be complex. You may need to think about children from previous relationships, your current spouse, and shared assets. Each person’s needs may differ, so clear planning is important.

Key considerations include:

Deciding how to divide your estate among your spouse, children, and stepchildren

Naming guardians for minor children

Making sure your wishes are clearly outlined in legal documents

A well-drafted will is the essential first step. It can help avoid misunderstandings and outline your intentions. You may also want to use trusts or mutual wills to protect your family’s interests and ensure each member is treated fairly. Trusts can provide ongoing support, while mutual wills keep agreements in place even if your spouse remarries.

A simple overview of common estate planning tools:

Unique Challenges in Blended Family Estate Planning

Blended family estate planning in British Columbia involves extra layers of complexity. You must consider legal, emotional, and financial factors to ensure that all family members are protected and your wishes are clear.

Conflicts of Interest Between Spouses and Children

Conflicts can arise when you want to provide for your new spouse and also protect children from a previous relationship. For example, if you leave everything to your spouse, your children may risk being disinherited if your spouse later changes their own will. These situations often create tension and mistrust between family members.

Estate plans for blended families should include clear instructions and legal safeguards. Using trusts, life estates, or naming both spouse and children as beneficiaries can help reduce the risk of disputes. Professional executors are sometimes chosen to handle these situations with objectivity and to preserve family harmony.

Balancing Inheritances Among Stepchildren and Biological Children

Balancing inheritances is often a sensitive issue. Biological children may expect a certain share from your estate, while stepchildren may also feel entitled if they have been treated as part of the family. Without clear planning, disagreements may arise, leading to will challenges or disputes.

You have several tools to ensure fairness, such as allocating fixed percentages, designating specific assets, or creating separate trusts for each child. A table like the one below can help you compare possible strategies:

Recognition of Stepchildren Under BC Law

Under British Columbia law, stepchildren do not automatically have the same inheritance rights as biological or legally adopted children. If you want a stepchild to be included in your estate, you must clearly name them in your will. Otherwise, they could be excluded entirely.

This distinction can lead to stepchildren unintentionally being left out, even if you have a close relationship. For this reason, careful and explicit instructions are important. If you do not specify your wishes, the standard legal rules may not match your family’s needs.

Legal Framework in British Columbia

Blended families in British Columbia face unique legal issues when dealing with estate planning. The province’s laws specify how assets should be distributed, what happens without a valid will, and the rights of spouses and dependents.

Wills, Estates and Succession Act Provisions

The Wills, Estates and Succession Act (WESA) is the main law for estate matters in British Columbia. WESA allows you to decide who receives your assets, but it also protects the rights of certain family members.

WESA requires clear language in your will about who your beneficiaries are. This means that if you want your stepchildren to inherit, you must name them directly. If you do not, they are not automatically included.

WESA also lets courts change a will if a spouse or child was not treated fairly. This is called a wills variation claim. If a blended family member feels left out or treated unfairly, they can ask the court to review the will.

It is important to update your will after marriage, divorce, or after having new children. WESA takes these events into account and can revoke or change certain parts of your will after your family structure changes.

Intestacy Rules and Their Impact on Blended Families

If you die without a valid will, WESA’s intestacy rules decide who gets your property. These rules divide assets in a fixed way.

A surviving spouse will usually get the first portion of the estate called the “preferential share.” The rest is split between the spouse and biological children. Stepchildren do not have a right to inherit under intestacy laws unless they are legally adopted.

For blended families, this can mean your stepchildren or spouse’s children could receive nothing. Only biological and adopted children have rights, so it is important to make a will stating your wishes.

Important points to remember:

Stepchildren must be included in the will to inherit.

Intestacy may not reflect your wishes for a blended family.

Planning reduces family disputes.

Spousal and Dependent Rights

Spouses and dependent children in British Columbia have specific rights under WESA. Your spouse, including a common-law partner, can make a wills variation claim if not properly provided for in your will.

Dependent children who were financially supported by you can also apply to the court for a share of the estate. Stepchildren, however, are only considered dependents if you treated them as your own and provided financially for them.

The court will look at your relationships and financial obligations. It can overrule your will to provide for those who depend on you. This is designed to prevent unfairness and hardship in blended family situations.

If you want to make sure all members of your blended family are protected, use clear language and be specific in your estate plan.

Developing an Estate Plan Tailored to Blended Families

As you now know, careful attention is needed to specify your wishes and protect all family members, including children from previous relationships and new spouses.

Key Considerations for Beneficiary Designations

Clear beneficiary designations are essential in blended families. If you have children from a previous marriage and a new spouse, you need to be specific about who will inherit each part of your estate. Failing to update your will or beneficiary forms can lead to accidental exclusion of stepchildren or children from a prior relationship.

Registered plans (like RRSPs and TFSAs) and life insurance policies often pass outside your will. Make sure each account or policy lists the correct beneficiary. Review these designations when family dynamics change.

Joint property can present another complication. Assets held jointly with a spouse usually go directly to them, which may bypass your children altogether. You should consider if joint ownership supports your goals or whether another arrangement is better.

Your will should also include guardianship instructions if you have minor children. It is important to reconsider your executor choice to avoid potential conflicts.

Ensuring Fairness and Minimizing Disputes

Blended families often worry about being fair to all children and preventing disagreements. You can help by communicating openly with family members about your estate plan, so expectations are managed from the start.

Trusts are a useful tool that can allow you to provide for your spouse during their lifetime while also protecting your children’s inheritance. For instance, a spousal trust can ensure your spouse receives support and assets eventually go to your children. This approach helps balance your obligations to both your new and previous families.

Listing specific assets in your will for different beneficiaries can also reduce disputes. For example, you might leave a family heirloom to a child from a first marriage and financial assets to another child.

Choosing an impartial executor is critical. An unbiased executor can administer the estate smoothly and reduce chances of conflict.

Wills for Blended Families

Careful planning allows you to protect both your current spouse and your children from a previous relationship.

Types of Wills Suitable for Blended Families

Several types of wills may fit your situation depending on your family's needs. A standard will lets you decide who inherits your property, but it may not protect stepchildren or prevent future changes after your death.

A mutual will is one option commonly used by blended families. This means you and your spouse make separate wills that include similar terms, often promising not to change the terms without the other's consent. These are formal agreements that give more security so your wishes are respected after your passing.

Another option is using a trust in your will. This arrangement lets you set aside assets for specific beneficiaries and timelines. A trust can help manage when and how children or stepchildren receive their share. Planning with a lawyer can help you select the right structure for your wishes.

Inclusion of Stepchildren and Step Relations

If you want your stepchildren or other step-relatives to inherit, you must name them clearly in your will. In BC, stepchildren do not have automatic rights to your estate unless they are included directly.

State each beneficiary's full name and their relationship to you, so there is no confusion about your wishes. You may also want to set specific gifts or percentages for each person. Including stepchildren in your legacy can support family unity and ensure fairness.

Regularly review your will as relationships change. Life events like a new marriage, the birth of children, or changes with step-relations can affect your wishes. Update your will as soon as possible if your situation changes.

Clauses to Prevent Will Contests

Adding certain clauses to your will can reduce the chances of disputes after your death. A no-contest clause, for instance, states that anyone who challenges the will risks losing their share. This clause may discourage family members from disputing your final wishes.

It is also important to explain your decisions clearly, either in the will itself or in a letter to your executor. Providing reasons for unequal gifts or exclusions can show the court that your choices were intentional and minimize the chance of legal challenges.

You should have witnesses and keep your will updated to make it legally sound. Working with an experienced lawyer also helps reduce mistakes that could lead to contests.

Trusts as Tools for Blended Family Estate Planning

Trusts are valuable estate planning tools that can help ensure your wishes are carried out, especially in blended family situations. Using trusts can provide control over how assets are managed and distributed, protect children’s inheritances, and balance support for both your current spouse and children from previous relationships.

Family Trusts for Blended Families

A family trust allows you to transfer assets into a legal structure while you are still alive. You, or someone you choose, can manage the trust as the trustee. You decide who benefits from the trust and when they will receive their share.

Family trusts are particularly useful in blended families when you want to provide for your spouse but also make sure your children are protected. For example, you can arrange for your spouse to have access to the income from the trust while reserving the capital for your children in the future. This structure can help prevent conflicts and ensure assets are passed on as intended.

Testamentary Trusts

A testamentary trust is created in your will and comes into effect after your death. It provides guidelines for how assets should be used and who can benefit. In blended families, testamentary trusts are commonly used to balance the interests of a surviving spouse and children from an earlier marriage.

For instance, you can create a spousal trust, allowing your spouse to receive income or use property during their lifetime. When your spouse dies, the remaining assets go to your children. This helps ensure that everyone is cared for and that your children are not disinherited through later changes in your spouse’s estate. Testamentary trusts are an effective solution to safeguard inheritances and maintain fairness in complex family structures.

Inheritance Protection Strategies

Estate planning for blended families in British Columbia requires taking specific steps to ensure every family member’s interests are protected. Strategies such as life insurance and giving assets during your lifetime can help provide clarity and avoid future disputes.

Life Insurance and Beneficiary Designations

Using life insurance is a practical way to provide for your spouse, children, and stepchildren. When you name a specific beneficiary on a life insurance policy, the proceeds are paid directly to that person, bypassing your will and probate.

This means you can leave financial support to one group, such as your children from a previous marriage, while ensuring your current spouse receives other assets. Properly structured life insurance policies give you more control over who receives what. Make sure to review your policies after any major life change, such as marriage or divorce.

Gifting Assets During Lifetime

Transferring assets before death is another way to protect your family’s inheritance. This method gives you the opportunity to see how assets are received and used by your loved ones.

Common ways to gift assets include giving money, property, or investments to children or stepchildren while you are still alive. In some cases, you may wish to use formal agreements or trusts to ensure the process is fair and transparent.

Making gifts during your lifetime can also help reduce potential conflicts by making your intentions clear. It is important to speak with a legal or tax advisor to understand the effects of these gifts, such as possible tax obligations or how they impact your overall estate value.

Role of Executors and Trustees in Blended Families

Choosing the right executor and trustee is essential for blended families in British Columbia. Executors are responsible for managing your estate after you pass, while trustees handle any ongoing trusts.

Blended families often involve children from earlier relationships and new spouses. These connections can lead to unique conflicts or disagreements.

It is wise to consider a professional or neutral executor and trustee. This helps avoid personal bias and reduces the risk of family disputes, especially when there are complex family dynamics. A neutral party can focus on carrying out your wishes as outlined in your will or trust documents.

Some families select co-executors, such as one person from each side of the family. This arrangement may help balance interests and foster trust between family members. However, working together as co-executors can also cause delays if there are disagreements.

Key factors to consider when selecting executors and trustees:

Ability to remain impartial

Legal and financial knowledge

Communication skills

Willingness to take on responsibility

For blended families, naming the right executors and trustees will help ensure your estate plan is managed smoothly and fairly.

Tax Considerations in Estate Planning for Blended Families

When you plan your estate as part of a blended family in British Columbia, understanding tax implications is important. Taxes can shape how your assets pass to your spouse, children, and stepchildren.

Capital Gains Tax:

When assets like property or investments are transferred after death, your estate might pay capital gains tax. Generally, this tax is applied if the assets have increased in value since you bought them. Transferring an asset to your spouse usually allows the estate to defer this tax until your spouse sells or passes away.

RRSPs and RRIFs:

Registered accounts such as RRSPs and RRIFs may be taxed as income at death unless they are left to a spouse or a dependent child. If you name your current spouse as the beneficiary, taxes on these accounts can be deferred.

Life Insurance Proceeds:

Life insurance payouts usually go directly to the named beneficiary and are not taxed. Carefully naming beneficiaries helps keep these funds outside the estate and avoids added probate fees.

Trusts and Tax Planning:

Trusts, like spousal or joint partner trusts, can hold assets for your spouse or children. They may help manage taxes and control how assets are shared. These tools are useful for blended families trying to balance support between partners and children from previous relationships.

Second Marriages and Remarriage Considerations

When you enter a second marriage, estate planning becomes more complex. You may have children from previous relationships and new stepchildren to consider. Without careful planning, your assets may not be distributed as you intend.

It is common for people in blended families to worry about fairness between current spouses, biological children, and stepchildren. British Columbia law does not automatically guarantee inheritance rights for stepchildren.

Here are some key considerations for second marriages:

Beneficiary Designation: Make sure to update your will, insurance policies, and registered accounts to reflect your new circumstances.

Spousal Agreements: Consider a marriage or cohabitation agreement to clearly outline financial expectations and protect your estate plans, especially if your family situation changes. Learn more about these agreements for blended families from the CLE BC guide.

Trusts: A trust can help ensure your spouse is supported but that your children still receive an inheritance after your spouse’s passing.

Conflicts may arise if there are unclear wishes or if assets are not kept separate. You should regularly review and update your plans as family relationships and laws may change.

Planning intentionally lowers the risk that children from a prior relationship are left out or that new stepchildren are unintentionally excluded.

Handling Family Businesses and Joint Assets

Managing a family business or joint assets in a blended family can be complex. Different family members may have separate interests. You should clearly outline who will manage or inherit business interests and shared property.

A written plan can help avoid disputes later. Consider the following steps:

List all joint assets, including property and investments

Specify your wishes for each asset in your will

Decide if you want to split assets equally or give certain items to specific people

You may want to use a trust to protect assets for your children from a previous relationship. A trust lets you set rules for when and how beneficiaries get their share.

Dispute Resolution and Mediation Options

Estate disputes can arise more often in blended families due to the complex relationships and competing interests. Resolving these issues early can help protect family relationships and assets. In British Columbia, several approaches are available to address estate disagreements.

Mediation is a private process where a neutral third party helps everyone involved reach an agreement. You and the other parties meet with a mediator, who guides the discussion and encourages fair solutions. Mediation is usually faster and less expensive than going to court.

Group facilitation can be useful when many people are involved, such as adult children from different marriages. This approach encourages open communication and helps everyone voice their concerns.

Collaborative law is another method where each person hires a specially trained lawyer. All parties agree to resolve their dispute without the threat of court proceedings. Meetings are joint and focus on reaching a shared solution.

Below is a comparison of the main options:

To find a professional, you can reach out to organizations like the Alternate Dispute Resolution Institute of BC or Family Mediation Canada. If you are unsure, a lawyer or mediator can help you choose the best path. Read more about other dispute resolution options in BC.

Practical Steps for Reviewing and Updating Estate Plans

Begin by gathering all current estate planning documents, such as wills, trusts, and powers of attorney. Review each document to ensure that your wishes, especially regarding your spouse, children, and stepchildren, are still reflected.

It is important to update beneficiary designations on assets like registered accounts and life insurance. Check that these designations match your overall plan and account for each family member appropriately.

Create a list of your assets and debts. This helps you and your advisors determine how best to divide your estate.

Key steps to follow:

Consult a legal professional who has experience with blended families in British Columbia.

Update or draft new wills if there have been changes, such as remarriage or the birth of a new child.

Consider trusts to control how and when assets are distributed to your spouse and children, including from previous relationships.

Open communication with all family members is important. Clear discussions help prevent future disputes and confusion regarding inheritances for your blended family.

Review your estate plan regularly, especially after major life changes. Keeping plans current helps ensure that your intentions are respected and your loved ones are protected.

Choosing Legal and Financial Advice for Blended Families

When planning your estate in a blended family, you should seek specialized legal and financial advice. Blended families often have unique needs that require a thoughtful approach.

Key reasons to consult professionals:

Laws in British Columbia may affect how your assets are divided among your spouse, biological children, and stepchildren.

Mistakes in planning can lead to disputes or unintended outcomes.

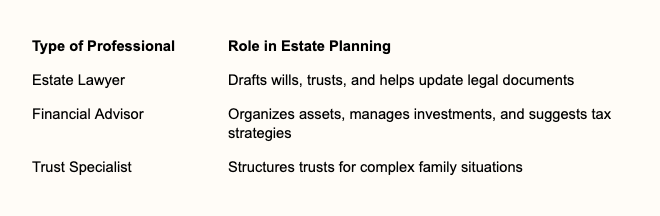

Important professionals to consider include:

A lawyer with experience in blended family matters can help you develop a will that is clear and fair for all family members. This includes setting up trusts to ensure your wishes are carried out.

Ask questions about their experience with blended family estates. Make sure they understand British Columbia’s specific rules for wills and inheritance.

A financial advisor can help you balance supporting your spouse and providing for children from past relationships. They can also help you review beneficiary designations on life insurance and retirement plans. Proper advice can reduce the risk of conflict and ensure your intentions are honoured.

The Final Verdict

Effective estate planning for blended families in BC requires thoughtful strategies to navigate complex relationships and ensure your wishes are honoured. A well-drafted plan can help prevent misunderstandings, minimize conflict, and provide for all family members according to your intentions.

For legal guidance tailored to the unique needs of blended families, contact the lawyers at Parr Business Law. Our experienced team can help you build a comprehensive estate plan that protects your legacy and brings peace of mind.