Executor Fees in BC: Understanding Compensation for Estate Administration

In British Columbia, executors are entitled to fair compensation for the time, effort, and responsibility involved in administering an estate.

Executor fees are governed by provincial law and are typically based on the size and complexity of the estate, subject to court approval or the terms of the will. Understanding how these fees are determined helps both executors and beneficiaries manage expectations and ensure transparency throughout the estate administration process.

This article explains the rules around executor compensation in BC and key factors that influence the amount awarded.

Executor Fees Overview in BC

If you act as an executor, you may be entitled to financial compensation for the work you perform. The amount depends on several factors, including estate size and the complexity of the tasks involved.

Definition of Executor Fees

Executor fees are the payments you receive for managing and settling someone’s estate when named as executor in their will. These fees cover your time and effort spent on duties such as collecting assets, paying debts, and distributing property to beneficiaries.

The fee does not include reimbursements for out-of-pocket costs like travel or postage. Instead, executor compensation is strictly for your work done as executor. In British Columbia, executor fees are usually calculated as a percentage of the gross value of the estate. This amount must be reasonable and is subject to approval by the beneficiaries and the courts.

Executor compensation is capped at a maximum of 5% of the estate’s total value. This cap ensures that compensation remains fair to both the executor and the beneficiaries.

Purpose of Executor Compensation

As an executor, you may spend months or even years managing estate assets, filing taxes, and dealing with legal processes.

Compensation helps to offset the workload and potential stress involved. It also makes it easier for executors, especially those with other jobs or commitments, to accept the role. The set fee aims to discourage only those with financial interests from accepting the position, while fairly rewarding those who do the work.

Compensation can also help avoid disputes by providing a clear structure for payment.

Legal Authority for Executor Fees

British Columbia law determines the rules for executor fees. The Trustee Act, RSBC 1996, c. 464, gives executors the right to claim reasonable compensation for their services. This amount may not exceed 5% of the estate’s gross value unless the will sets a different amount.

Courts consider factors such as the complexity of the estate, the amount of time required, the skill needed, and the success in administering the estate. All fees claimed must be either approved by the beneficiaries or reviewed by the court if there is a disagreement.

How Executor Fees Are Calculated

Executor fees in British Columbia depend on a few key rules and standards. Understanding how the fee amounts are decided helps you plan, manage, and explain costs clearly.

Percentage-Based Fee Structure

In British Columbia, executor compensation is often based on a percentage of the estate’s total value. Typically, the maximum fee is up to 5% of the gross aggregate value of the estate, including income earned during administration. This applies to both assets and money managed or collected.

For example, if an estate is valued at $400,000, the maximum fee can be $20,000. These fees are not paid upfront. Fees are generally paid after estate debts, taxes, and expenses have been settled.

Many executors divide their fee into categories such as capital receipts, capital disbursements, and income collected. Each may have a recommended percentage, but the total must not go above 5%.

Statutory Guidelines and Discretion

The Trustee Act of British Columbia sets out that executor compensation must be “fair and reasonable,” not exceeding 5% of the gross estate value. Courts in BC may review fees to ensure they fit these requirements.

Fees are only finalized after beneficiaries are consulted and, if necessary, approved by the court. The law does not define a minimum fee. Instead, your compensation depends on the actual work done and the complexity of the estate.

While 5% is the cap, the court has the power to reduce this if the services do not justify the full amount. The court’s discretion helps prevent over- or under-compensation in unique or complicated cases.

Factors Affecting Fee Determination

Several factors influence the final fee you can claim. These include:

Size and complexity of the estate

Time and skill required for administration

Number of beneficiaries or assets involved

Any special problems or disputes during the process

If the estate is simple, the fee may be much lower than the 5% maximum. More complex estates, or those requiring extensive work, support a higher fee within the legal limit.

Courts will examine the tasks you performed, time spent, and whether you acted efficiently and prudently. Beneficiaries may also challenge an executor’s compensation if they believe it is too high.

Duties and Responsibilities Impacting Compensation

The duties you perform as an executor directly affect the amount of compensation you may receive. The more complex and time-consuming your responsibilities, the more likely it is that your compensation will reflect your efforts.

Managing Estate Assets

Your first responsibility is to identify, secure, and manage all assets in the estate. This includes locating bank accounts, real estate, personal items, investments, and business interests.

You are often required to appraise assets and keep detailed records. This may involve hiring valuators or other professionals if you are not able to do this on your own. Protecting the estate, such as keeping insurance policies current and monitoring investments, is essential.

Keeping accurate lists and monitoring the condition of assets helps you demonstrate the complexity and scope of your work. Estates with more assets or with assets that are difficult to manage (such as overseas property or a private business) require more time and effort, which can justify higher executor fees.

Paying Debts and Taxes

Paying off any debts and settling taxes is one of your main responsibilities as executor. You must review and verify all creditor claims before making payments.

Filing the deceased’s final tax returns, including income tax and possibly GST/HST, is necessary. You may also need to deal with Canada Revenue Agency to obtain a clearance certificate to confirm that all taxes are settled. This process can be lengthy and involves careful record-keeping.

Any mistakes made in this stage can expose you to personal liability. Being diligent about paying debts and taxes ensures that beneficiaries receive their inheritances only after all obligations are fully met. These tasks can significantly increase your workload and impact your eventual compensation.

Distributing the Estate

Once debts and taxes are settled, your next task is to distribute estate assets to beneficiaries according to the will. This can involve transferring funds, handling real estate sales, and dividing personal items.

In cases where there are multiple beneficiaries or disputes over assets, the process may become more complicated. Clear communication and proper documentation are essential to ensure all beneficiaries are treated fairly and that the terms of the will are followed.

Delays or errors in distribution can lead to complaints from beneficiaries or disputes that require court involvement. The time and effort spent resolving these issues can be factored into your compensation as executor.

Court Approval and Disputes

Since executor fees in British Columbia are subject to legal rules and oversight, court approval may sometimes be required, and disputes between executors and beneficiaries can arise.

Requirement for Court Approval

If all beneficiaries agree to the executor’s proposed compensation and sign off on the accounts, court approval is not needed. However, if there is any disagreement, the executor must seek formal approval from the court.

The court decides if the fee is fair by reviewing the work done, the complexity of the estate, and whether the executor managed everything properly. This process protects both executors and beneficiaries by ensuring fees are reasonable and justified.

Common Grounds for Dispute

Disputes over executor fees in British Columbia often arise for several reasons. A beneficiary may feel the executor is asking for too much compensation or that the fee does not match the amount or quality of work performed. Concerns may also appear if expenses claimed by the executor are not clearly explained or seem unrelated to the administration of the estate.

Complex estates can cause further issues, especially if they involve businesses, foreign assets, or complicated investments. Sometimes, more than one executor or beneficiary disagrees with how the fee is split or calculated. Transparency and careful record-keeping are important to prevent misunderstandings and complaints. Clearly communicating with all parties can also reduce the risk of disputes.

Resolving Executor Fee Disputes

If a dispute develops, the first step is often negotiation between the executor and the beneficiaries. Open communication and sharing detailed records of all work and expenses may help resolve concerns. If an agreement cannot be reached, the matter can be presented to the court for review.

The court will consider the value of the estate, the difficulty of the tasks involved, the amount of time spent, and the executor’s performance. The court’s decision will set the final compensation. It is important for you to keep clear records and provide evidence to support your position.

Executor Fee Agreements

Executor compensation can be decided in advance, or discussed after the estate process begins. Understanding your options helps you receive fair payment for your work as an executor.

Fee Arrangements in the Will

The person who writes the will (the testator) may choose to state a specific fee or a formula, for executor compensation in the will. This can make your job easier by reducing confusion and disputes later on.

A clear fee arrangement in the will allows you and the beneficiaries to know what to expect. The fee can be a fixed amount, a specific percentage, or a method for calculating the total. For example, if a will states the executor is to receive 3% of the estate’s value, this becomes the starting point.

British Columbia law still requires all executor fees to be “fair and reasonable,” even if a fee is written into the will. If the agreed fee seems too high or low compared to the work performed, the court can review and adjust it if necessary.

Negotiating Executor Compensation

If the will does not specify a fee, you may need to negotiate your compensation with the estate’s beneficiaries. In BC, the law allows the executor to claim up to 5% of the gross value of the estate, but the exact amount can be negotiated based on the size and complexity of the estate.

There is also a potential annual care and management fee of up to 0.4% of the average market value of the assets, if the executor manages assets over time.

Clearly documenting your time, responsibilities, and expenses will support your request for fair payment. You should also consider the expectations of the beneficiaries and communicate openly to avoid conflicts.

A formal agreement or written record helps prevent future misunderstandings. If there is disagreement, beneficiaries can ask the court to review the fee and set an amount the court finds reasonable.

Tax Implications of Executor Fees

Executor fees in British Columbia are subject to specific tax rules. You must understand how these fees are taxed as income and whether they are deductible as estate expenses.

Taxable Income Treatment

Executor fees in British Columbia are treated as taxable income by the Canada Revenue Agency (CRA). If you accept compensation for acting as an executor, you are required to report these amounts as part of your personal income in the tax year you receive them.

The fees you receive are considered earned income, and they must be declared on your income tax return. If you are not in the business of providing executor services, the fees are included under "other income." If you do provide executor services as part of your regular business, they may count as business income and could be subject to GST.

Deductibility Considerations

Executor fees paid from an estate in British Columbia are generally deductible expenses for the estate itself. An estate may claim these amounts as an administration expense when calculating the taxes owed on any income earned by the estate.

Deducting executor fees can help reduce the taxable income of the estate before final distribution to beneficiaries. It is important to keep all receipts and records to justify the deduction during any tax review or audit.

The deduction is only available to the estate, not to you as an individual executor.

Professional and Corporate Executor Fees

When you choose a professional or corporate executor, such as a trust company or law firm, you will face different fee structures than with a private individual. These companies handle complex estates and carry extra responsibilities.

Professional and corporate executors often charge fees based on a percentage of the gross value of the estate. A typical fee structure may look like this:

You may also see extra charges for ongoing care of the estate, such as management of trusts or investments. Some firms add hourly rates or administrative costs on top of the percentage.

Factors that can affect professional fees:

Size and complexity of the estate

Number of assets or beneficiaries

Legal or tax issues

These fees must still be “fair and reasonable” under BC law. The court may review fees to ensure they reflect the actual work done.

Reducing or Waiving Executor Fees

You may choose to reduce or waive executor fees in British Columbia, either as the executor or as part of the estate planning process. This is often done for family reasons, tax purposes, or where the estate is simple and does not require much effort to administer.

Ways to reduce or waive fees include:

The will can specify a lower fee or state that no fee is to be paid.

As executor, you can choose to decline part or all of your compensation.

Beneficiaries may agree in writing to a reduced payment.

Common reasons for waiving fees:

Important considerations:

Tax implications: In Canada, executor fees are treated as taxable income. If you inherit money instead, it may not be taxed as income.

Court involvement: If there is disagreement about fees, the court may decide what is fair. The Trustee Act sets a maximum fee, but actual payment can be less.

Discuss any decision to reduce or waive fees with the beneficiaries to avoid disputes later in the process.

Contingencies Affecting Compensation

Several factors can influence your compensation as an executor in British Columbia. The final fee is not automatic and may vary based on the circumstances of the estate.

Complexity of the Estate

You may receive higher compensation if the estate involves complex assets, multiple properties, or challenging legal issues. Simple estates with only a few assets or accounts may result in lower compensation.

Estate Value

Your fee is often a percentage of the gross value of the estate. As discussed, in BC, the maximum is 5% according to the Trustee Act, but the exact amount is assessed case by case.

Time and Effort Required

If administering the estate requires significant time or special skills, this may increase your fee. Routine tasks such as simple distributions may justify only a modest payment.

Executor’s Experience

You do not need to be a professional, but courts may adjust fees based on your skill level and experience. More skilled executors might handle duties more efficiently, affecting how compensation is calculated.

Disputes and Family Challenges

Situations involving disputes among beneficiaries, will challenges, or claims against the estate may increase your workload. Fees can reflect these additional demands, especially if you are required to stay neutral in family conflicts.

List of Key Contingencies:

Size and value of the estate

Number and type of assets

Legal or tax complexities

Time, effort, and skill required

Level of conflict or dispute among beneficiaries

Need for professional assistance

Courts in BC aim to determine fair and reasonable compensation, taking all these factors into account.

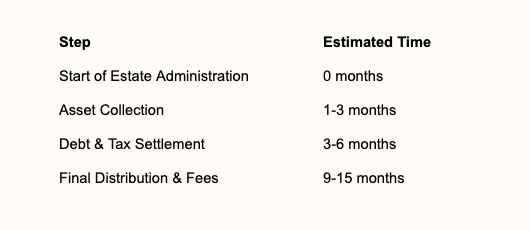

Timeframe for Receiving Executor Fees

As an executor in British Columbia, you are usually paid after the estate has been fully administered. You do not receive compensation right away. Most executor fees are distributed once all assets are collected, debts are paid, and the remaining estate is ready for final distribution to beneficiaries.

It is common for this process to take about 12 months, sometimes longer. Delays can occur if assets are hard to sell or if the estate is complex. During this period, your reasonable expenses may be reimbursed, but your official fee is generally withheld until the end.

Common steps before receiving your fee include:

Completing an inventory of assets

Paying estate debts and taxes

Preparing a final report for beneficiaries

Gaining approval for compensation, either from beneficiaries or the court

Executor compensation must be approved before payment. This often involves agreement from all beneficiaries. If there is a dispute, a probate judge may decide the amount and timing.

Table: Typical Timeline for Executor Fee Payment

You should keep detailed records throughout this process to support your request for fees and make approval easier.

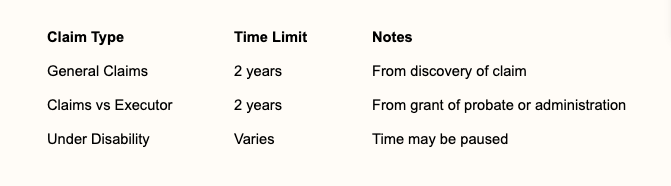

Statute of Limitations for Claims

When making a claim against an executor in British Columbia, you need to understand the statute of limitations. This is the legal deadline for anyone who wishes to bring a claim.

In most cases, you have two years to start a claim after the grant of probate or letters of administration. If you wait longer than two years, you may lose your right to sue the executor.

The Limitation Act of British Columbia sets the default time limit for civil claims. Unless another law applies, the Limitation Act will govern your claim period. Many claims must be made within two years of discovering the legal issue. Review details at the Province of BC’s Limitation Act guide.

Some exceptions exist. If you are under a disability, the time limit may be paused or “suspended” until you are capable of managing your own affairs. This can affect when you are allowed to start a claim.

Table: Basic Time Limits for Claims

The Final Verdict

Executor fees in BC are designed to provide reasonable compensation for the duties performed, reflecting the time and complexity involved in managing an estate. Whether you are drafting a will or acting as an executor, it’s important to understand how these fees are calculated and applied.

For guidance on executor compensation, estate administration, or drafting clear provisions in your will, contact the lawyers at Parr Business Law. Our team can help you navigate the process with clarity, compliance, and confidence.