Overview of the Lifetime Capital Gains Exemption in BC

The Lifetime Capital Gains Exemption (LCGE) is an important tax planning tool for business owners, farmers, and fishers in British Columbia. It allows eligible individuals to shelter a portion of capital gains from tax when selling qualified assets. Understanding how the exemption works, who qualifies, and how it fits into broader tax and estate planning is essential to maximizing its benefits.

This article provides an overview of the Lifetime Capital Gains Exemption and its relevance for individuals in BC.

About the Lifetime Capital Gains Exemption

The Lifetime Capital Gains Exemption lets you reduce or avoid tax when you sell certain assets. In British Columbia, the exemption follows federal tax rules and applies to specific property types, limits, and conditions that you must meet.

Eligibility Criteria

You can claim the exemption only if you are an individual, not a corporation or trust. You must be a Canadian resident during the year of sale.

For Qualified Small Business Corporation (QSBC) shares, you must own the shares at the time of sale. The corporation must meet strict tests. At least 90% of its assets must be used in an active business in Canada at the time of sale. During the prior 24 months, more than 50% of assets must also meet this test.

You must report the gain and file the proper election when you sell. The exemption does not apply automatically. Missing forms can delay or deny your claim, even if you otherwise qualify.

Applicable Assets

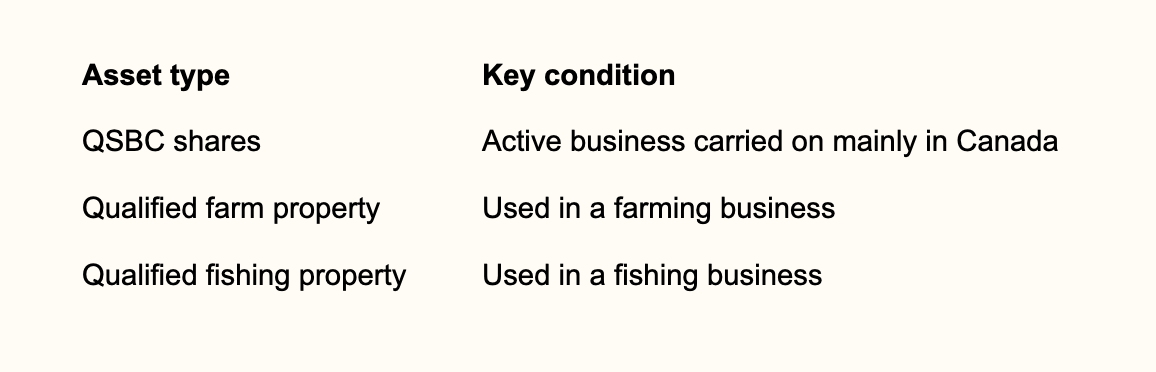

The exemption applies only to specific property. You cannot use it for rental real estate, public company shares, or personal-use property.

Eligible assets include:

QSBC shares are the most common asset in BC. They often arise when you sell a private company, including many technology and professional service firms. Complex ownership structures can affect eligibility, especially when holding companies are involved.

Exemption Limits

For dispositions after June 25, 2024, you can exempt up to a lifetime limit that is $1.25 million in 2024 and indexed thereafter (projected about $1.275 million in 2026) of eligible capital gains on qualified small business corporation (QSBC) shares and qualified farm or fishing property. This is a lifetime limit per person. If you used part of your LCGE in past years, that usage reduces what remains under the higher, indexed limit.

QSBC shares and qualified farm or fishing property share the same LCGE pool but have different qualification tests. The LCGE shelters the taxable portion of capital gains—subject to the current inclusion rates and thresholds—so a qualifying gain within your remaining LCGE can often be fully offset, resulting in no regular capital gains tax on that gain.

Lifetime Capital Gains Exemption and Estate Planning

You can reduce future tax by using the Lifetime Capital Gains Exemption (LCGE) as part of your estate plan. The rules affect how you transfer a business, plan succession, and manage tax at death in British Columbia.

Implications for Small Business Owners

If you own a qualifying small business, the LCGE can shelter up to about $1.275 million of capital gains on eligible shares in 2026. This rule applies only if your company meets strict tests at the time of sale or transfer.

You need to hold qualified small business corporation shares, not just any private company shares. The tests look at asset use and holding periods. Many owners fail these tests without advance planning.

Key points you should track:

Share ownership structure

Business asset mix

Past use of your LCGE

Poor records or late planning can reduce or remove the exemption.

Integration with Succession Planning

Your estate plan should align with how and when you transfer your business. A sale during your lifetime often gives more control than a transfer at death.

In BC, death triggers a deemed disposition, which can create tax even if no sale occurs. Proper planning can allow you to use the LCGE before this happens.

Common succession tools include:

Freezing the value of your shares

Transferring growth to children or a family trust

Selling shares gradually over time

Estate planners often stress the role of LCGE in succession.

Tax Deferral Strategies

You can defer tax while keeping access to the LCGE with careful timing and structure. Deferral does not remove tax, but it spreads it over years or shifts it to a lower-tax event.

Common strategies include:

Estate freezes to cap current value

Family trusts to multiply access to the LCGE

Rollover transfers to a spouse

Each option carries legal and tax risk if done incorrectly. Professional guidance matters, especially as the exemption amount changes over time.

Your plan should reflect your age, health, and exit timeline.

Transferring Assets Through an Estate

When you transfer assets through an estate in British Columbia, tax rules apply before beneficiaries receive property. Capital gains, rollover options, and trust structures all affect how much tax the estate pays and what beneficiaries receive.

Deemed Disposition Rules

At death, tax law treats you as if you sold most capital property at fair market value just before death. This rule applies even though no sale occurs. The Canada Revenue Agency calls this a deemed disposition.

Assets affected often include real estate, shares, mutual funds, and some personal property. Any increase in value creates a capital gain that you must report on the final tax return. The estate pays this tax before distributing assets.

You can avoid immediate tax in some cases. A transfer to a surviving spouse or a spousal trust often qualifies for a rollover at cost. This defers tax until the spouse sells the asset or dies. The CRA explains how capital gains arise at death in its guidance on taxable capital gains on property at death.

Impact on Beneficiaries

Beneficiaries do not usually pay tax when they receive an inheritance. The estate settles tax first. This reduces the value of what beneficiaries receive.

When a beneficiary later sells inherited property, new tax rules apply. The starting value becomes the fair market value at the date of death. Any gain after that date belongs to the beneficiary.

Key effects you should plan for include:

Lower estate value after paying capital gains tax

Delays in distribution while the executor files returns

Different outcomes based on asset type and timing of sale

Use of Trusts

Trusts can change how and when assets transfer through your estate. A spousal trust allows assets to pass to your spouse while deferring capital gains tax. The trust holds the property, and your spouse receives income or use.

You can also use other trusts to control timing and access. These trusts may protect assets for minors or vulnerable beneficiaries. They can also manage future tax exposure.

In some cases, the executor may choose not to use a rollover. This choice can help use capital losses or exemptions.

Trust planning requires careful drafting and tax advice. The structure must match your estate goals and family needs.

Utilizing the Exemption Upon Death

When you die, tax law treats many assets as if you sold them at fair market value. You can reduce this tax by using the Lifetime Capital Gains Exemption and by planning how assets pass to your spouse.

Reduction of Estate Tax Liabilities

At death, you face a deemed disposition of most capital property. This can trigger capital gains tax even though no sale occurs. The CRA explains how this works for property and investments under Canada’s rules on deemed disposition of capital property at death.

You can apply the Lifetime Capital Gains Exemption (LCGE) to offset gains on qualified small business shares and qualified farm or fishing property. The exemption can shelter up to a fixed lifetime limit, which can remove or reduce tax on your final return.

Key points you should review:

Asset type and eligibility for the LCGE

Fair market value at death

Available capital losses to offset gains

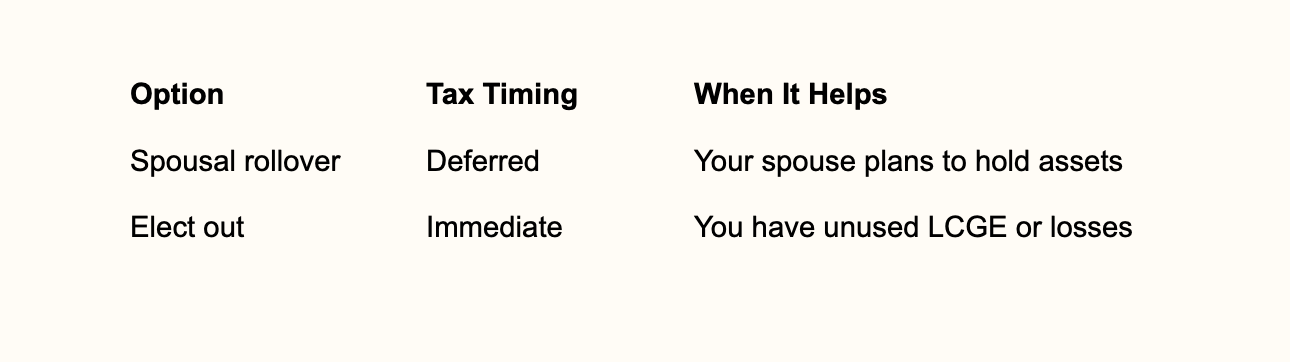

Optimizing Use of Exemptions by Spouses

If you have a spouse, you can often defer capital gains tax by using the spousal rollover. This allows assets to pass to your spouse at cost, not fair market value.

You may choose to trigger gains on death instead of deferring them. This approach can:

Use your unused LCGE

Use personal tax credits on your final return

Reduce future tax when your spouse later sells the asset

Planning Strategies for Maximizing the Lifetime Capital Gains Exemption

Careful planning can protect your access to the Lifetime Capital Gains Exemption when you transfer a business or plan your estate in British Columbia. Two common strategies focus on fixing today’s value and keeping your corporation eligible at the time of sale.

Estate Freeze

An estate freeze lets you lock in the current value of your business for tax purposes. You exchange your common shares for fixed‑value preferred shares. This step caps your future capital gain at today’s value.

New common shares then go to your children or a family trust. Any future growth shifts to them. This structure can allow multiple family members to use their own Lifetime Capital Gains Exemption.

An estate freeze also helps with estate planning. You gain clearer control over future taxes and timing. When planned early, it can reduce tax at death and support a smooth business transition.

You must meet the rules for qualified small business corporation shares. Professional advice matters, since mistakes can limit or deny the exemption.

Purification of Corporations

Purification focuses on keeping your corporation eligible for the exemption. To qualify, most of the company’s assets must support an active business carried on in Canada.

You may need to remove excess cash or passive investments. Common steps include:

Paying bonuses or dividends

Transferring assets to a holding company

Paying down corporate debt

Timing matters. The rules apply both at the sale date and during the prior 24 months. Regular reviews help you avoid last‑minute fixes.

Clear records also matter. If the Canada Revenue Agency reviews your claim, strong documentation supports your position when you claim the Lifetime Capital Gains Exemption in Canada.

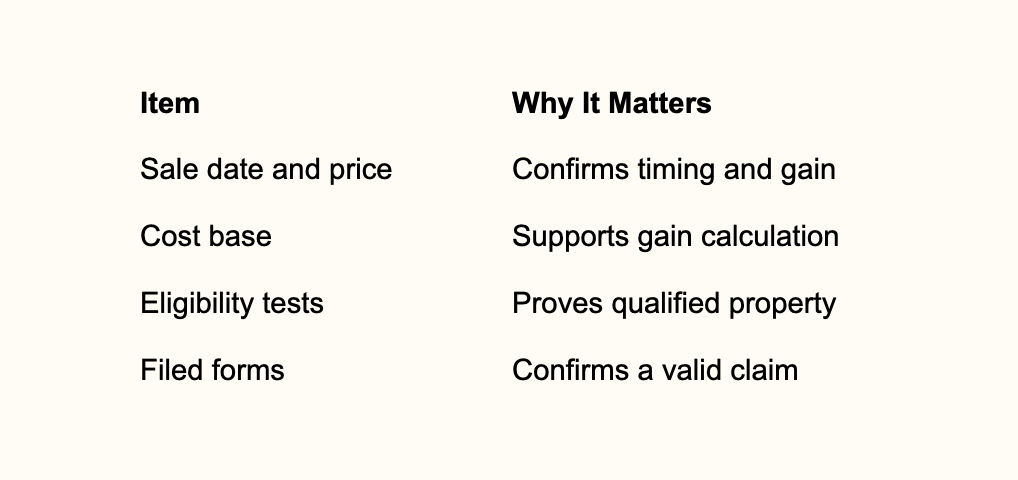

Record-Keeping and Reporting Requirements

You must keep clear records to support a Lifetime Capital Gains Exemption claim. Good records help you prove eligibility and respond to Canada Revenue Agency reviews.

Keep the following documents for at least six years after the year of sale:

Purchase and sale agreements

Share certificates or ownership records

Financial statements showing asset use

Valuations and appraisal reports

Prior LCGE claims, including amounts used

Accurate tracking matters because past claims can reduce your available exemption. Claims made in 1994 or earlier may still affect your limit, as outlined by TaxTips.ca on the LCGE rules.

You must report the sale in the year it occurs. You calculate the gain and report it on Schedule 3 with your personal return, following the steps explained by the CRA for calculating and reporting capital gains and losses.

You also need to file the LCGE election form. The exemption does not apply automatically, even if you qualify. Filing details appear in guidance on claiming the Lifetime Capital Gains Exemption.

Recent Legal Developments and Legislative Changes in BC

Recent federal tax changes affect how you plan for the Lifetime Capital Gains Exemption (LCGE) in British Columbia. These changes apply across Canada and shape estate and business succession planning in BC.

In June 2024, the federal government raised the capital gains inclusion rate. For individuals, the rate increased from one-half to two-thirds on annual capital gains above $250,000. Corporations and most trusts now face the higher rate on all capital gains.

The government also increased the LCGE limit. The exemption rose to $1.25 million for qualified small business shares and qualified farm or fishing property, effective June 25, 2024. This change expands tax relief when you transfer or sell eligible assets.

Timing rules matter. The $250,000 threshold for the higher inclusion rate becomes effective January 1, 2026, which affects how you schedule asset sales. KPMG outlines this timing issue in its discussion of the capital gains tax increase deferred to 2026.

You should also note ongoing refinements to intergenerational transfers. Amendments to Bill C-208 add conditions to reduce misuse while preserving access to the LCGE for genuine family business transfers, as discussed in this review of Bill C-208 amendments and restrictions.

Professional Guidance and Advisory Considerations

You should work with qualified professionals when using the Lifetime Capital Gains Exemption (LCGE) as part of your estate plan. The rules are detailed, and small errors can reduce or deny the exemption. Advisors help you apply the rules correctly under British Columbia and federal tax law.

A tax advisor or accountant can confirm whether your assets qualify. They also review share structure, asset tests, and prior LCGE use.

A lawyer plays a different role. You rely on legal advice to align the LCGE with wills, trusts, and shareholder agreements. Estate documents must match your tax strategy to avoid conflicts or delays during administration.

You may benefit from coordinated advice. Many plans work best when your advisors collaborate.

Professional roles often include:

Tax advisor: Eligibility checks, tax projections, and filing support

Lawyer: Estate documents, trusts, and succession structure

Financial advisor: Cash flow planning and long-term goals

You should also plan for future rule changes. Federal updates to capital gains and exemptions can affect timing and structure.

You protect your estate by documenting advice and decisions. Clear records support your position if the Canada Revenue Agency reviews the claim.

The Final Verdict

The Lifetime Capital Gains Exemption can significantly reduce tax liability when selling qualifying assets, making it a critical consideration for business and succession planning in BC. Proper structuring and advance planning are essential to ensure eligibility and maximize the available exemption.

For personalized advice on using the LCGE as part of your tax or estate planning strategy, contact the attorneys at Parr Business Law. Our team can help you navigate the rules and implement a plan that protects your wealth and long-term goals.