At What Net Worth Should You Setup a Trust in Canada: Key Factors and Financial Considerations

Deciding when to establish a trust is an important financial and estate planning decision for many Canadians. While trusts can offer significant benefits—such as tax efficiency, asset protection, and control over how wealth is distributed—they also involve setup and administrative costs.

Understanding at what net worth it becomes worthwhile to create a trust depends on your financial goals, asset structure, and long-term planning objectives.

There is no legal minimum net worth required to establish a trust in Canada. This article explores the key factors that influence whether a trust is right for you and when it becomes a smart move from a financial perspective.

Understanding Trusts in Canada

In Canada, a trust allows you to manage and protect assets under clear legal terms. It helps you decide how your property, investments, or business interests are handled during your life and distributed after death. Knowing what a trust is, what types exist, and how they work legally can guide your estate planning decisions.

Definition of a Trust

A trust is a legal relationship where one party (the trustee) holds and manages assets for the benefit of another (the beneficiary). The person who creates the trust is the settlor. This arrangement is governed by a legal document known as a trust deed, which outlines the rules for handling the assets and distributing income or property.

Trusts exist separately from your personal estate, which allows them to offer protection against certain claims or taxes. The trust deed determines exactly how and when assets will be distributed. This clarity helps prevent disputes while preserving your intentions.

The main value of a trust lies in its ability to separate ownership and control. You can transfer your assets to a trustee, but still ensure they are used according to your wishes for your beneficiaries.

Types of Trusts Available

In Canada, there are two primary forms of trusts. Inter vivos trusts are created while you are alive, while testamentary trusts are established through your will and take effect after death. Each type serves different purposes depending on your financial and family situation.

An inter vivos trust can help with tax planning, privacy, and asset protection. A common example is a family trust, often used to hold business shares or investments. A testamentary trust, on the other hand, helps control how your assets are distributed to heirs, such as limiting access for minor children.

You may also encounter bare trusts, which offer direct ownership benefits but fewer controls. Other forms include charitable remainder trusts, which support registered charities while providing lifetime income to the settlor.

How Trusts Operate Legally

Legally, a trust operates through the trustee’s fiduciary duty to manage assets according to the trust deed and the applicable laws in your province. Trustees must keep records, file required tax returns, and manage trust property in the best interest of all beneficiaries.

Trust assets are kept in a segregated trust account, which holds investments and income separately from personal assets. This separation helps ensure transparency and compliance.

Some provinces, such as Quebec, have additional legal requirements. For example, an independent trustee—someone not standing to inherit—must be appointed in all Quebec trusts, according to Raymond James.

The Canada Revenue Agency (CRA) also imposes rules about income reporting and beneficiary distributions. Understanding these obligations helps you avoid penalties and maintain proper compliance with tax and estate laws.

Net Worth Thresholds for Trust Setup

A trust helps you manage, protect, and transfer wealth efficiently. In Canada, your reason for setting up a trust often depends on the value and complexity of your assets, as well as your goals for tax planning, privacy, and estate control.

General Guidelines for Net Worth

There is no legal minimum net worth required to establish a trust in Canada. However, experts often recommend one when your assets reach a level where professional administration and tax strategy become beneficial. According to Money Couch, a trust can hold property, investments, or other valuable assets and can be either living or testamentary.

Households with about $1 million or more in assets often find trusts useful for protecting wealth and controlling how it transfers to beneficiaries. At this stage, you likely own property, investment portfolios, or business interests that a trust can secure from taxes, probate, and disputes.

For smaller estates, a simple will may suffice. But once your financial affairs involve multiple asset classes, multiple heirs, or business operations, a trust becomes a cost-effective planning tool.

Common Asset Levels for Trust Creation

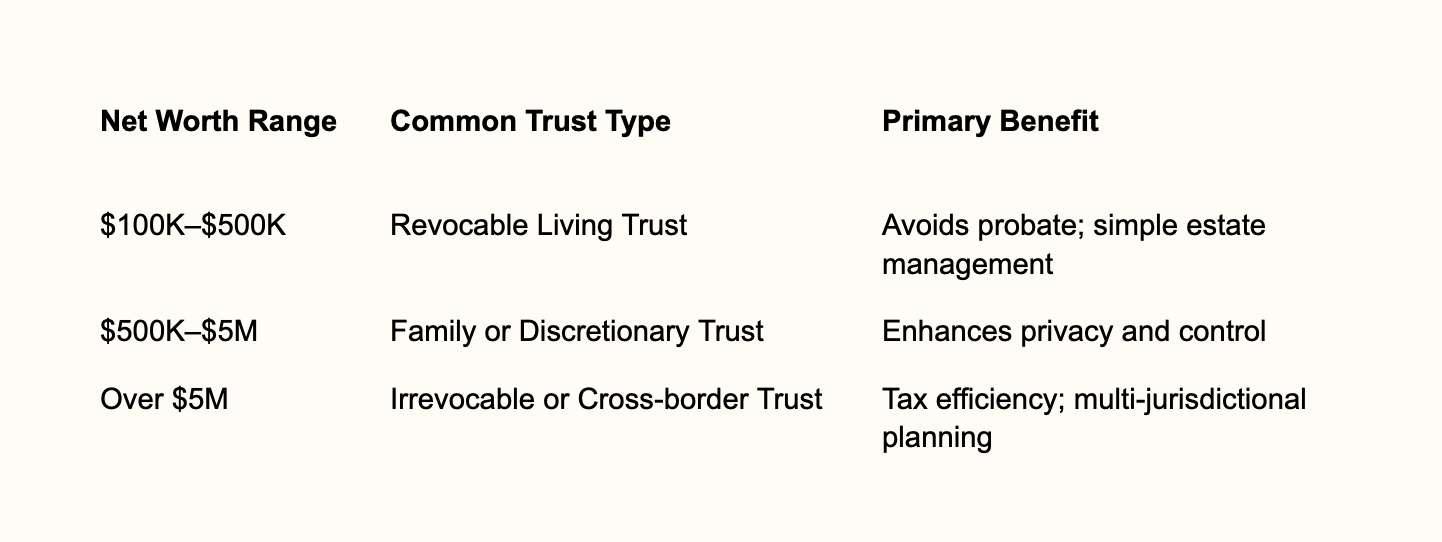

Different trust thresholds reflect different goals. A general rule is that if your net worth exceeds $100,000, you can explore a revocable living trust to avoid probate and simplify asset distribution, as suggested by Finance Band.

In mid-range estates, around $500,000 to $1 million, a trust enhances privacy and helps manage investment income or rental properties. Those with $10 million or more often use irrevocable or cross-border trusts to address tax mitigation and international holdings, based on KnowYourBest’s analysis.

Tailoring Trusts to Individual Financial Situations

Your trust choice should match your financial structure, not just your net worth. A trust becomes useful once you own assets worth protecting or plan to transfer them efficiently.

If your wealth includes business shares or multiple properties, an inter vivos trust can separate business and personal assets. Families with dependants may use a discretionary trust to manage future costs and ensure responsible use of funds.

Cross-border ownership requires special handling. Such trusts can prevent multiple probate events for international assets. By aligning your trust with your asset types, goals, and family needs, you create a plan that balances flexibility, control, and compliance with Canadian tax law.

Key Factors Influencing Trust Establishment

Your decision to create a trust should consider the type of assets you own, the people you want to provide for, and the level of protection your estate may need. Each of these areas affects how a trust should be structured to meet your long-term goals.

Asset Composition Considerations

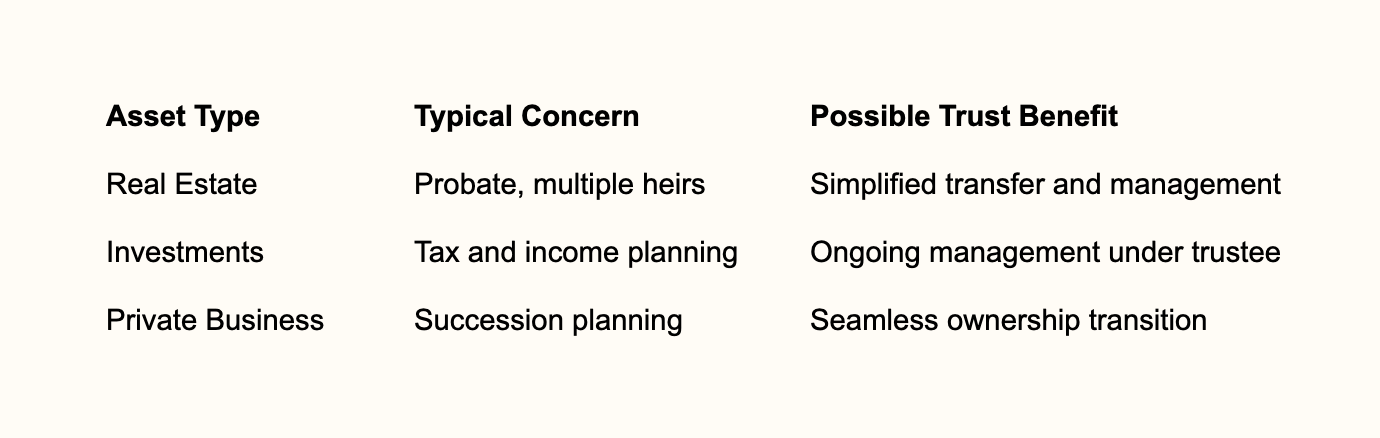

Your mix of assets plays a key role in deciding whether a trust is appropriate. If you hold real estate, investment portfolios, or business interests, a trust can help you manage these assets more efficiently and ensure they pass according to your wishes. In Canada, households with about $1 million or more in assets often find that a trust offers administrative and tax planning benefits.

Liquid assets such as cash or publicly traded stocks are easy to transfer through normal estate processes, but non-liquid assets—like family cottages or private companies—can cause delays or disputes. Placing these in a trust can prevent fragmentation of ownership and reduce legal complications.

A simple comparison can help you evaluate your estate:

Family and Beneficiary Needs

Your family structure and the circumstances of your beneficiaries affect the type of trust you may create. A family with minor children might choose a trust that manages money until the children reach maturity. If you have dependants with disabilities, you can use a trust to maintain their financial security without affecting benefits.

When family relationships are complex—such as blended families or multiple marriages—a trust can clearly outline who receives what, reducing potential conflict. Family dynamics are often one of the strongest motivators for establishing a trust because they determine how flexible and detailed the terms need to be.

You can also appoint professional trustees to maintain impartiality. This approach adds oversight and ensures that your assets are managed based on agreed rules rather than emotional decisions.

Risk Management and Protection

You may also use a trust to protect assets from potential risks, such as creditors, lawsuits, or future family disputes. Trusts offer asset protection through legal separation between personal ownership and the trust itself. This separation can shield certain assets when properly structured, particularly for business owners and professionals with higher liability exposure.

For real estate investors or entrepreneurs, trusts can keep personal wealth distinct from business risks. You might also use them to minimize estate taxes or govern how money is used after death.

Trusts can help in stabilizing wealth across generations. When combined with other estate planning tools, such as wills and insurance, they create a balanced strategy for long-term financial protection and efficient management.

Tax Implications of Trusts in Canada

Establishing a trust in Canada affects how income, capital gains, and other assets are taxed. You need to understand how the Canada Revenue Agency (CRA) treats different income types, what tax-planning advantages may apply, and what reporting obligations trustees must meet.

Income and Capital Gains Tax

A trust is treated as a separate taxpayer under the Income Tax Act (Canada). It must file an annual return and pay tax on income not distributed to beneficiaries. The CRA generally taxes trusts at the top marginal rate on retained income, which makes distributing that income to beneficiaries an important consideration.

The income and gains you distribute to beneficiaries retain their original character. For example, dividends paid from Canadian corporations to a trust that then passes them to a beneficiary are still considered dividends to that beneficiary. If you hold assets that appreciate in value, a capital gain is triggered when the trust sells or transfers them.

Every 21 years, most Canadian trusts face a deemed disposition on all capital assets. This rule, explained in detail in Understanding the 21‑Year Rule for Trusts in Canada, requires the trust to pay tax on all accrued gains as if it had sold its property. Planning around this rule can help minimize unexpected taxes.

Tax Planning Benefits

Trusts can offer several tax‑planning opportunities if structured and administered properly. Income can be distributed to beneficiaries in lower tax brackets, which may reduce the overall family tax burden. Certain trusts, like family trusts, allow you to hold and manage assets efficiently while taking advantage of income splitting.

If you own shares of a private corporation, a separate trust can also hold those shares as part of an estate freeze or succession plan. This strategy helps lock in capital gains at current values while allowing growth to transfer to the next generation. You can further defer taxes by timing distributions or allocating income to specific beneficiaries based on their personal tax situations.

Tax advantages still depend on compliance with CRA rules. Understanding the differences between trust types and income classifications is essential to avoid penalties or loss of tax benefits.

Compliance and Reporting Requirements

Trustees carry legal responsibility for correctly managing and reporting all trust activity. Each year, you must file a T3 Trust Income Tax and Information Return if the trust earns income or distributes funds. The trust must also prepare T3 slips for each beneficiary who receives income.

Recent CRA rules have increased transparency by requiring more detailed disclosure about trustees, settlors, and beneficiaries. These measures aim to curb tax avoidance and ensure all parties are clearly identified.

You should retain accurate records of all trust transactions, including income allocations, distributions, and valuations of assets. Trustees must also keep minutes of decisions and maintain documentation supporting tax reporting. Incomplete or late returns can lead to significant penalties, so consistent compliance is essential for preserving both legal standing and tax efficiency.

Steps to Establishing a Trust Based on Net Worth

Determining when and how to establish a trust depends on your financial standing, asset types, and long-term goals. Decisions about structure, management, and compliance influence both the trust’s effectiveness and its ability to protect wealth.

Assessing Your Financial Portfolio

Start by listing all your assets — real estate, investments, businesses, and personal property. Identify which ones you want to transfer into a trust. Pay special attention to properties and holdings that could trigger probate or higher taxes.

Next, calculate your total net worth to see whether a trust would offer meaningful advantages. Some advisors recommend considering a trust when your assets exceed $100,000, as discussed in FinanceBand’s guide. At this level, managing assets through a trust can simplify estate transfers and protect beneficiaries.

You should also identify income-generating assets that may require complex management, such as rental properties or investments. These assets often benefit most from the oversight and clarity that a trust provides. Create a simple table to compare which assets should be included:

Selecting the Appropriate Trust Structure

Choose a trust type that aligns with your financial goals. Options include family trusts, living trusts, and testamentary trusts. In Canada, family trusts are commonly used to transfer wealth while minimizing taxes.

A living trust offers flexibility because you can modify or revoke it during your lifetime. It helps manage complex estates or assets like businesses and international property.

Each trust type has distinct legal and tax implications. For example, a living trust avoids probate while a testamentary trust takes effect only after death. Review each structure’s costs, ongoing maintenance, and reporting duties before making a decision.

Consulting With Professional Advisors

Seek guidance from an estate lawyer, accountant, and financial advisor before finalizing your trust. A professional team ensures compliance with Canadian tax laws and prevents administrative errors that could invalidate the trust.

An estate lawyer drafts the trust deed, ensuring your wishes are legally binding. Tax advisors determine how income from trust assets should be reported and advise on potential savings. Financial planners confirm that the trust structure supports your investment and retirement strategy.

Using professionals also helps you anticipate changes in taxation or law that could affect your plan. A consultation checklist can help you stay organized:

Legal: Verify trust deed wording and terms

Tax: Confirm reporting and filing requirements

Financial: Align trust with broader wealth goals

This coordinated approach ensures that your trust functions as intended and remains efficient over time.

Trusts for Business Owners and Entrepreneurs

You can use a trust to manage company ownership, protect intellectual property, and structure how profits flow to your family or estate. This approach may reduce tax burdens, safeguard valuable assets, and help ensure a smooth business transition over time.

Business Assets and Succession Planning

A trust can hold business shares, property, or other assets to support long-term continuity. If you plan to pass your business to family members, a trust can provide clear rules about ownership and management. By transferring shares into a family trust, you can define who benefits from dividends and capital growth.

In Canada, many owners establish trusts to avoid disputes and reduce probate costs during transitions. A family trust can assist with succession planning by maintaining control while distributing income according to your direction. You may also minimize tax exposure by using the lifetime capital gains exemption when shares are sold, if the trust is set up properly under Canadian tax law.

Use the trust as part of a detailed estate plan. This can give you flexibility if family dynamics or business priorities change over time.

Protecting Intellectual Property

Your business may depend on intellectual property such as patents, trademarks, or software. Placing these rights in a trust can separate them from your operating company. This helps shield them from potential creditors or disputes that could arise in the business.

Trusts also allow control over how your intellectual property is used or licensed. For example, the trust can hold ownership of a brand, while the operating company pays a licensing fee. This setup supports consistent income and protects the long-term value of your work.

A trust provides clear documentation of ownership. This is especially helpful when several family members or partners are involved. According to Zenbooks, structuring ownership this way can strengthen asset protection and improve business stability.

Funding Trusts With Corporate Earnings

A trust typically receives funding from dividends or retained earnings transferred from your business. You can move income into a discretionary or family trust where trustees decide how to allocate distributions to beneficiaries.

This structure provides flexibility in income planning. For example, you can distribute funds to family members in lower tax brackets. Some owners use these arrangements when their net worth exceeds about one million dollars or when their financial affairs become complex.

Joint Ownership Structures

Joint ownership can serve as a straightforward way to transfer assets. When you share property with a spouse or family member as joint tenants with right of survivorship, ownership passes directly to the survivor when one owner dies. This bypasses probate and usually avoids legal delays.

However, joint ownership has limitations. You lose full control over your asset, as joint owners must agree on major financial decisions. It can also create tax implications and expose assets to the other owner’s potential debts or legal claims.

Compared with a trust, joint ownership is simpler and cheaper to set up but offers less protection and control. A trust can separate beneficial ownership from legal ownership, giving you flexibility in managing distributions and maintaining confidentiality.

Insurance-Based Solutions

Insurance-based approaches, such as insurance trusts or designated insurance beneficiaries, combine protection with estate planning flexibility. These arrangements can ensure that funds from life insurance policies go directly to chosen beneficiaries without probate delays.

According to Manulife, insurance trusts can help with wealth transfer strategies, particularly when beneficiaries have specific needs or when you want to minimize estate taxes. This structure also shields policy proceeds from creditors.

You may prefer insurance-based strategies when seeking liquidity for estate taxes or supporting dependants quickly after your death. While they do not manage multiple assets like a revocable or irrevocable trust, they function as a targeted tool in a broader estate plan. Combining insurance-based planning with trusts can balance simplicity, privacy, and efficiency.

Legal and Regulatory Considerations

You must set up and manage a trust according to Canadian trust law and provincial regulations. Your province determines how trustees operate, how trust property is registered, and how financial reporting must be maintained to ensure compliance.

Provincial Trust Legislation

Each province in Canada has its own trust legislation. For example, the Trustee Act in Ontario outlines a trustee’s powers, investment authority, and duties. Other provinces, such as British Columbia and Alberta, have similar statutes but may differ in areas like trustee appointment or investment standards. Understanding these details helps you avoid procedural mistakes.

When you create a trust, you must identify the settlor, trustee, and beneficiary roles clearly to meet legal requirements. A trust in Canada must also comply with rules that define how ownership of assets transfers to the trustee and how beneficiaries receive benefits.

You should also review tax implications, as both federal and provincial tax agencies oversee reporting for income earned inside the trust. Professional advice is often necessary to ensure the structure matches your province’s estate laws and wealth management goals.

Ongoing Trustee Responsibilities

After establishing a trust, you must maintain compliance through accurate record keeping, timely filings, and ethical management of assets. A trustee assumes a fiduciary duty to act in the best interests of beneficiaries at all times. This duty includes prudence and accountability.

A trustee must keep detailed financial statements, follow the terms of the trust deed, and ensure tax obligations are met each year. For example, the structure of a trust account in Canada includes obligations to manage assets responsibly and document decisions.

Common responsibilities include:

Preparing annual trust returns

Providing beneficiaries with financial summaries

Managing distributions under the trust’s terms

Neglecting these duties can result in legal liability or removal as trustee. You must show consistent care and transparency to meet both provincial and federal expectations.

The Final Verdict

While there is no fixed net worth threshold for setting up a trust in Canada, individuals with substantial assets, complex family structures, or specific tax and succession goals often find trusts highly beneficial. Establishing a trust can help preserve wealth, minimize taxes, and provide greater control over how assets are managed and distributed.

For personalized advice on whether a trust aligns with your financial and estate planning needs, contact the attorneys at Parr Business Law. Our team can help you assess your situation and design a trust structure that protects your wealth and legacy.