Who Should Consider Setting Up a Trust: Key Factors and Benefits to Evaluate

Trusts can be a valuable estate planning tool, but they are not necessary for everyone.

Deciding whether to set up a trust depends on several factors, including the size and complexity of your estate, family circumstances, tax considerations, and your desire for control over how assets are managed and distributed. Individuals with business interests, blended families, minor or vulnerable beneficiaries, or significant assets may benefit most from a trust.

This article outlines who should consider setting up a trust and the key benefits to evaluate when determining if a trust is right for your estate plan.

Understanding Trusts

You can use a trust to organize, protect, and distribute your assets under controlled conditions. This legal arrangement divides ownership and control between you, the trustee, and the beneficiaries, offering flexibility in tax planning and wealth transfer.

Definition of a Trust

A trust is a legal agreement where you transfer ownership of assets to a trustee. The trustee manages those assets on behalf of beneficiaries according to the terms you set out in the trust deed. This arrangement separates legal ownership from beneficial ownership, ensuring that assets are used as intended even after your death.

In Canada, trusts often form part of estate planning and can reduce probate fees or protect family wealth. Reviewing your financial goals and listing all assets before creating a trust helps you determine whether it suits your situation. Trusts can hold property, bank accounts, investments, or business shares, and they can last for many years under properly drafted rules.

You must appoint a capable trustee. This person or institution manages your trust assets responsibly and follows the deed’s legal instructions. The arrangement is binding and enforceable under both federal and provincial laws.

Types of Trusts

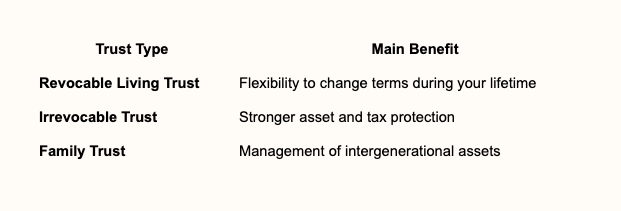

There are several forms of trusts, each serving distinct purposes. The most common are living trusts (created while you are alive) and testamentary trusts (established through your will). Living trusts can be revocable or irrevocable, depending on whether you wish to retain control.

Revocable trust: You can change or cancel it during your lifetime.

Irrevocable trust: Once created, its terms cannot be changed.

Family trust: Designed for managing and distributing assets to relatives.

Bare trust: The trustee holds assets without active management duties.

Certain structures, such as testamentary trusts, become effective after death and are common in Canadian estate planning. These trusts can simplify estate administration and ensure the smooth transfer of wealth to chosen beneficiaries.

How Trusts Operate

A trust operates under a trust deed or agreement that outlines who the trustee and beneficiaries are, what assets the trust holds, and how distributions occur. Once you transfer assets, the trustee takes legal ownership and must follow the trust’s terms.

You, as the settlor, define the trust’s purpose—such as supporting minors, caring for dependants, or managing business assets. The trustee must act within fiduciary duties, meaning they must act in beneficiaries’ best interests and comply with tax and reporting laws.

Under Canadian tax law, trusts are separate entities and must file annual returns. According to Think Accounting’s overview, trustees are responsible for ensuring compliance with these obligations while distributing income properly. Trust income can either be taxed within the trust or attributed to beneficiaries, depending on structure and timing.

Effective trusts rely on accurate accounting, clear communication, and regular review to ensure they continue to meet your original objectives.

Individuals Who Should Consider a Trust

You may benefit from a trust if you have significant assets, own a business, or want to ensure financial stability for dependants. A well-structured trust can help manage taxes, protect property, and control how your wealth transfers to others.

High Net Worth Individuals

If you have substantial assets or large investment portfolios, a trust can help you manage and preserve wealth over time. By placing property, investments, or other high-value assets into a trust, you may be able to minimize estate taxes and maintain privacy around the distribution of your estate. Trusts can also shield assets from legal disputes or creditor claims, providing stronger protection for your beneficiaries.

Many people in this group consider trusts to ensure efficient estate planning and succession management. A trust can specify how and when beneficiaries receive funds, limiting the risk of misuse or mismanagement. Trusts allow for detailed control over distributions, which is especially important when directing multi-generational wealth transfers.

Common trust types for high net worth individuals include:

Business Owners

If you own a private company, a trust can help protect business assets and simplify ownership transfers. It can hold shares in your business, separate personal from corporate wealth, and plan for succession without disrupting operations.

A trust may also help reduce exposure to legal or creditor risks associated with operating a company. For instance, proper structuring can reduce risk from family disputes, lawsuits, and debt recovery actions. This can be especially useful in industries where liability concerns are significant.

Using a trust in your business planning can also help manage income splitting or provide retirement benefits to family members working in the company. In Canada, you can also prepare a testamentary trust to ensure your business continues operating smoothly after your death.

Parents With Minor Children

Parents often use trusts to secure their children’s financial future. You can set aside money or property that will be managed by a trustee until your children reach a responsible age. Funds can cover expenses such as education, health care, and daily living costs without giving minors full control.

Unlike direct inheritance, a trust gives you control over how and when your children access funds. You can outline specific conditions, such as access at a certain age or for specific purposes. Trusts clearly separate who manages the assets (trustee) from who benefits (beneficiary), offering structure and accountability.

If you pass away unexpectedly, a testamentary trust—activated through your will—can begin managing assets immediately, avoiding delays and reducing administrative costs that might arise through probate.

Those With Complex Family Structures

Blended families, second marriages, or dependants with special needs often create estate planning challenges. A trust can help balance competing interests fairly and prevent conflicts among heirs. You can protect assets for specific heirs while ensuring your spouse or partner receives ongoing support.

You may also use a trust to manage inheritances for stepchildren or dependants who require lifelong care. Clear instructions can prevent disputes and ensure consistent financial management. Trusts help avoid probate, which reduces costs and keeps family matters private.

In families where relationships are complex, a trust allows you to define your intentions with precision, support vulnerable relatives responsibly, and maintain discretion in how your estate is handled.

Trusts for Asset Protection

A properly structured trust allows you to separate ownership and control of assets, helping reduce risk exposure. This legal tool can protect your wealth from creditors, preserve it for your family, and limit losses during a divorce. Its effectiveness depends on careful planning and ongoing management.

Protecting Assets From Creditors

You can use a trust to protect your assets from claims or lawsuits. In Canada, a trust creates a legal separation between you and your property. The trustee manages the assets for your beneficiaries, while you reduce personal ownership risk. This structure means that, under certain conditions, creditors cannot easily reach those assets.

An asset protection trust can offer added strength if it is fully discretionary. This type allows the trustee to decide when and how distributions occur, limiting your direct control and reducing exposure to claims. According to guidance on shielding assets from creditors and family law claims, maintaining this discretion helps reinforce the separation between you and the assets.

Before establishing such a trust, you must ensure it is set up before any potential claim arises. Transfers made to avoid an existing or pending debt can be challenged by the courts. Seek legal advice to make sure the structure meets Canadian trust laws and remains lawful under provincial regulations.

Safeguarding Family Wealth

Families often use trusts to maintain long-term control and protection of their wealth. You can use them to manage inheritance, preserve assets for future generations, and prevent misuse. A trustee ensures that funds are spent or distributed according to the trust deed, not individual preferences or outside pressures.

Trusts also prevent the fragmentation of wealth. Keeping property in a single trust helps maintain its value and aligns distribution with family goals. For example, trusts as a strategy for wealth protection in Canada note that this structure helps preserve estates by avoiding constant division or sale of assets.

You can also design a trust for tax efficiency and to accommodate long-term planning. When structured properly, it may reduce estate taxes and ensure continuity of financial management after your death.

Protection in Divorce Cases

A trust can serve as a practical tool for asset protection in divorce. When your assets are held in a properly constructed trust, they are generally not treated as personal property. This can make them less vulnerable to division or claims during a marital dispute.

However, you must create and manage the trust carefully. If you retain too much personal control over the assets or use them for your own benefit, courts may still consider them part of your matrimonial assets. To strengthen protection, a discretionary trust—where the trustee decides if and when to distribute funds—creates distance between you and ownership.

To protect assets, clear and consistent trust management is essential. Proper oversight by an independent trustee ensures compliance with legal standards and reduces the chance of challenges. This approach can safeguard your estate while ensuring fair treatment of all parties involved.

Trusts for Estate Planning

A trust gives you control over how your assets are managed and distributed, while offering tax and legal advantages under Canadian law. It can help you transfer wealth efficiently, protect privacy, and reduce administrative challenges when settling your estate.

Avoiding Probate

When you create a trust, you can transfer your property to a trustee during your lifetime. This means the assets do not become part of your estate when you die. Because they bypass your estate, the assets in the trust usually skip probate. Probate is a legal process that validates a will and allows distribution of assets, which can be time-consuming and costly.

Avoiding probate can save your beneficiaries both time and expenses. In BC, for example, probate fees can be significant, especially for large estates. By using an inter vivos trust, you can pass assets directly to your beneficiaries without court involvement.

The trustee manages the assets according to the trust’s terms, providing clarity and avoiding potential disputes. This approach gives you greater control and simplifies the transfer process after your death.

Reducing Estate Taxes

A trust can help reduce taxes payable on your estate. By transferring assets into a trust, those assets may no longer be considered part of your taxable estate upon death. Depending on the type of trust, you might also defer or reduce capital gains tax.

For Canadians over 65, options like an Alter Ego Trust or Joint Partner Trust offer income-splitting and tax deferral benefits. These trusts allow the income to be taxed in your hands while you are alive rather than immediately triggered at death. This can reduce the immediate tax burden when transferring assets to family members.

It’s important to consult a tax advisor or estate lawyer to structure the trust properly. Improper planning can lead to unintended taxes or penalties.

Ensuring Privacy in Transfers of Wealth

When a will goes through probate, it becomes a public document, which means anyone can access its details. By contrast, assets held in a trust transfer privately. The arrangement remains confidential between you, your trustee, and your beneficiaries.

If you are managing sensitive matters such as a family business or significant property, a trust ensures that the specifics of your estate remain private. Trusts are especially useful when you wish to protect family information or maintain discretion about financial decisions.

Many families use this structure to avoid public disclosure of their asset values, beneficiaries, or inheritance details. This protection can be valuable for preserving harmony and avoiding challenges that public probate disclosures might cause.

Trusts for Specific Beneficiary Needs

Trusts can be structured to address the unique needs of beneficiaries who require special care, financial discipline, or long-term support. They allow you to tailor how and when funds are used while ensuring assets are managed responsibly by a trustee.

Providing for Family Members With Disabilities

If you have a loved one with a disability, a Henson trust can protect their financial security without affecting access to government benefits such as the Ontario Disability Support Program (ODSP). In this type of trust, the trustee has full discretion over distributions, meaning the beneficiary cannot demand or control the funds. This setup ensures that the trust assets are not counted as personal income or resources.

Proper trustee selection is essential, as the trustee must understand both the beneficiary’s needs and the legal requirements for maintaining benefit eligibility. Trustees often coordinate with social workers or financial advisors to handle expenses like medical equipment, housing, and caregiving services.

Henson trusts are recognized in several provinces, including BC, as a tool that preserves independence and maintains benefit eligibility for beneficiaries with disabilities. You can fund the trust during your lifetime or through your will to ensure continued support after your death.

Managing Inheritance for Spendthrift Beneficiaries

Some beneficiaries may struggle to manage money due to poor spending habits, addiction issues, or financial inexperience. In these cases, a spendthrift trust can protect the inheritance from misuse or creditor claims. You can specify how much and how often the trustee releases funds, such as monthly allowances or payments for education and living costs.

The trustee plays a central role by overseeing distributions according to your instructions, ensuring financial discipline. Courts and creditors generally cannot force the trustee to release assets directly to the beneficiary, adding another layer of protection.

This structure provides a balance between support and control, letting your loved one benefit from the inheritance without unrestricted access. Such arrangements help you protect assets while meeting your long-term goals for responsible wealth management.

Ensuring Long-Term Care for Dependents

Trusts can secure consistent care for dependents, such as children or elderly parents, by setting out precise financial instructions. A discretionary trust allows the trustee to make distributions based on the dependent’s changing needs, including healthcare, education, or assisted living expenses.

You can define conditions in the trust deed for when and how funds are released, offering flexibility as personal or medical circumstances evolve. This is particularly useful for dependents requiring lifetime financial support or specialized care.

Creating this type of trust can also reduce estate complications. The trustee’s duties include managing and distributing assets in accordance with the trust terms and applicable law, ensuring decisions are made in the beneficiary’s best interests.

Charitable Trust Considerations

When you plan to use your assets for charitable purposes, you need to understand how your objectives, funding methods, and tax implications align. Each element affects how effectively your trust carries out your wishes and maximizes benefits to both you and the charitable cause.

Philanthropic Goals

A charitable trust helps you support causes that reflect your personal or family values. You can direct funds toward areas such as education, health care, or environmental protection, ensuring your contributions continue to create impact over time.

Start by identifying specific, measurable goals. For example, you may wish to fund scholarships or support a hospital foundation. Consider whether you prefer to benefit one charity or multiple registered organizations in Canada. The Canada Revenue Agency outlines requirements for charitable registration and defines how funds must be used for public benefit.

You should also decide how much control you want to maintain over the distribution of funds. Choosing trustees with aligned values helps ensure the trust meets your objectives long after it is established.

Establishing Endowments

You can structure a charitable trust to create an endowment, which provides ongoing financial support to your chosen charities. This approach preserves the principal amount while distributing income generated from investments.

Your endowment may be fixed or flexible. A fixed endowment keeps the initial capital intact, while a flexible one allows the trustee to use part of the principal when needed. Choosing qualified trustees and clear terms is crucial to long-term stability.

You should also define the trust’s investment strategy and the frequency of distributions. Some individuals prefer annual grants, while others may opt for periodic disbursements tied to specific performance goals or timelines. Establishing transparent reporting requirements encourages accountability and maintains public trust.

Tax Benefits for Charitable Giving

A charitable trust allows you to give back while receiving tax advantages. Income generated within the trust grows tax-deferred, which can help preserve more assets for charitable purposes. You may also receive an immediate tax deduction for the value of the charitable remainder interest.

You can reduce your taxable estate, which may lessen the impact of capital gains or estate taxes upon transfer. For individuals seeking both financial planning and legacy creation, this structure provides flexibility.

Commonly, donors use appreciated securities, real estate, or life insurance policies to fund the trust. By transferring assets strategically, you can maximize both the charitable benefit and your long-term financial efficiency.

International and Cross-Border Trusts

When your financial or family ties extend beyond Canada, establishing a trust can help manage assets and meet legal obligations across different countries. These arrangements can reduce double taxation, simplify estate transfers, and support compliant wealth management.

Managing International Assets

If you own property or investments in more than one country, you may benefit from an international or cross-border trust. These structures let you hold assets in one jurisdiction while following the laws of another. They often help prevent issues that arise when nations have different tax and reporting rules.

For example, a cross-border trust can help manage wealth between Canada and the United States. This may include real estate, investment accounts, or shares in foreign companies. Using a trust ensures a clear plan for management and succession while helping to meet the tax obligations in each country.

Setting up this type of trust requires careful legal planning. You must consider where to locate the trustee, which laws apply, and how income and gains will be taxed. Professional advisors can help design the trust to meet both Canadian and foreign regulations.

Key considerations include:

Residency of the settlor, trustee, and beneficiary

Tax treaties between countries

Currency exchange rates and reporting rules

Compliance with anti-money laundering laws

Cross-Border Inheritance Issues

When your heirs or beneficiaries live abroad, cross-border inheritance can become complex. Each country may claim taxing rights on your estate or the trust income. Proper planning can reduce the risk of double taxation and administrative delays.

A cross-border estate plan for American and Canadian families illustrates how a trust can ensure assets transfer smoothly under two legal systems. It assigns a trustee who understands both jurisdictions and outlines how beneficiaries receive their inheritance.

If not handled correctly, conflicting rules can delay distributions or even trigger penalties. You should define clear terms in your trust and confirm that local laws in each country permit those arrangements.

Practical steps include:

Drafting wills that align with the trust’s cross-border terms

Identifying tax filing duties for both nations

Reviewing foreign inheritance or gift taxes

Keeping detailed documentation for all transactions and valuations

Reviewing Alternatives to Trusts

Before establishing a trust, you may want to examine other estate planning options. Each alternative offers certain benefits and may better fit your personal or financial situation.

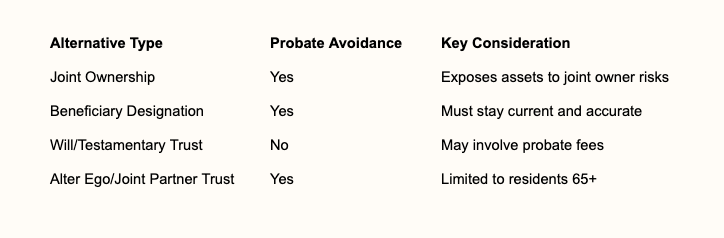

1. Joint Ownership:

Holding assets jointly with rights of survivorship can allow property to pass directly to the surviving owner without probate. However, this approach may expose your assets to the joint owner’s creditors or legal disputes.

2. Beneficiary Designations:

You can name beneficiaries on accounts such as life insurance, RRSPs, or TFSAs. This method transfers assets directly to beneficiaries, avoiding probate delays. Be sure to review and update designations regularly to reflect your current wishes.

3. Wills and Testamentary Trusts:

A detailed will ensures your estate is divided according to your instructions. A testamentary trust, created through your will, comes into effect after your death and can help manage assets for minors or dependants.

4. Alter Ego or Joint Partner Trusts:

If you are 65 or older, you may find an alter ego trust or joint partner trust useful for incapacity and probate planning. These trusts allow you to retain control of assets during your lifetime while simplifying the transfer process later.

Steps to Establishing a Trust

You should start by identifying your goals and needs. Decide why you want to create a trust—whether to manage family wealth, plan for your estate, or protect assets. Taking an inventory of your property, investments, and debts helps you understand what will go into the trust. Legal professionals recommend beginning with a clear overview of your assets and liabilities.

Next, choose the type of trust that suits your situation. Common options include revocable, irrevocable, living, and testamentary trusts. Each has different rules about control, taxation, and timing.

Then, appoint a trustee. This person or institution will manage the trust’s assets according to your instructions. Choose someone reliable who understands financial management and legal responsibility. You may also want to select a backup trustee in case the original one cannot serve.

After that, draft the trust agreement. Work with a lawyer to ensure the document meets legal standards and reflects your wishes clearly. The agreement should specify how assets are used, who the beneficiaries are, and when distributions occur.

Finally, fund the trust by transferring ownership of your assets to it. This step is crucial because an unfunded trust offers no legal protection. You must update property titles, financial accounts, and beneficiary designations to show the trust as the new owner.

The Final Verdict

Setting up a trust can provide meaningful benefits such as greater control, tax efficiency, asset protection, and flexibility in estate planning, but it should be carefully evaluated based on your unique circumstances. Understanding whether a trust aligns with your financial and family goals is essential before moving forward.

For personalized advice on whether a trust is appropriate for you, contact the attorneys at Parr Business Law. Our experienced team can help you assess your options and create an estate plan that protects your assets and supports your long-term objectives.