An Estate Lawyer Talks About The Biggest Mistakes He Sees With Wills And How To Avoid Them

Common Errors in Will Drafting

Many wills fail to reflect a person’s true intentions because of unclear wording, missing details, or mistakes in how the document is signed and witnessed. These errors can cause legal disputes, delay estate settlement, and increase costs for families. Careful drafting and regular review help ensure that a will remains valid and effective.

Ambiguous Language and Unclear Instructions

We often see wills that use vague or inconsistent terms. Phrases like “divide equally among my family” or “leave the house to my children” can create confusion about who qualifies as family or which property is included. Ambiguity can lead to court challenges and strained relationships among heirs.

To avoid this, we must use precise language. Each beneficiary should be identified by name and relationship. Assets should be described clearly, including addresses or account numbers where possible. According to FindLaw’s discussion of common drafting mistakes, unclear wording is one of the most frequent causes of probate disputes.

We recommend reviewing the will with an estate lawyer to ensure every instruction is understandable and legally sound. This step reduces the risk of misinterpretation after death.

Failure to Update Beneficiaries

Many people forget to update their wills after major life events such as marriage, divorce, or the birth of a child. Outdated beneficiary lists can leave former spouses or deceased relatives named in the document. This oversight can result in unintended distributions and family conflict.

We should review our wills every few years or after any significant change in personal circumstances. Treating a will as a “set and forget” document is a common and costly mistake.

A simple checklist helps track updates:

Keeping beneficiary information current ensures that our wishes remain accurate.

Omissions of Key Assets

A will must list all major assets, including real estate, bank accounts, and digital property. When key items are missing, those assets may pass under provincial intestacy laws instead of following our wishes.

We can prevent this by maintaining an inventory of assets. This list should include account details, property titles, and business interests. Failing to include all relevant assets can cause confusion and delay in estate administration.

It also helps to specify how debts, taxes, and jointly owned property should be handled. A complete record makes it easier for executors to locate and distribute assets correctly.

Improper Execution and Witnessing

Even a well-written will can be invalid if not signed and witnessed correctly. Each province in Canada has strict rules about how a will must be executed. Missing signatures or using unqualified witnesses can render the document void.

We must sign the will in the presence of two witnesses who are not beneficiaries. They should also sign in our presence. Improper witnessing is a frequent reason courts reject wills.

It is best to have an estate lawyer supervise the signing process. Proper execution ensures that the will meets legal standards and protects our intentions from challenge.

Legal Requirements Often Overlooked

We often find that even well-intentioned individuals miss key legal details that make a will valid. These errors can lead to disputes, delays in probate, or even the entire will being set aside by the court. Careful attention to provincial laws, signatures, and family rights helps prevent these problems.

Non-Compliance with Provincial Laws

Each province in Canada has its own estate legislation that defines how a will must be created and executed. When we fail to follow these rules, courts may declare the will invalid. For example, British Columbia’s Wills, Estates and Succession Act (WESA) sets specific requirements for witnesses, signatures, and revocations.

People often assume a will template found online applies everywhere. It usually does not. Even small differences in wording or procedure can cause legal complications.

To stay compliant, we should:

Confirm the testator signs in the presence of two witnesses.

Ensure witnesses are not beneficiaries.

Use language that meets local legal definitions.

A lawyer familiar with provincial law ensures every clause meets current standards and avoids costly mistakes.

Invalid Signatures

A will without valid signatures is not legally binding. We often see documents signed incorrectly—sometimes missing a witness signature or completed after the testator’s death. These errors make the will unenforceable.

Proper witnessing is essential for validity. Both witnesses must sign in the testator’s presence, and the testator must sign voluntarily and with mental capacity.

Common mistakes include:

Using electronic signatures where not permitted.

Having witnesses sign at different times.

Forgetting to initial changes or corrections.

We should always review the signing process carefully to ensure compliance with legal standards.

Neglecting Spousal and Dependant Rights

Canadian law protects spouses and dependants from being unfairly excluded from a will. When we overlook these rights, the estate may face legal challenges. Courts can override the will to provide adequate support.

Failing to account for family obligations often leads to disputes. This includes not updating a will after marriage, divorce, or the birth of a child.

To avoid conflict, we should:

Review the will after major life events.

Include clear provisions for dependants.

Understand provincial family law requirements.

Respecting these rights ensures fairness and reduces the risk of litigation.

Consequences of DIY Wills

When people create their own wills, they often overlook legal and financial details that can cause serious problems later. Errors in wording, witnessing, or tax planning may lead to disputes and reduce the value of the estate passed to beneficiaries.

Increased Risk of Litigation

Homemade wills often fail to meet the legal standards required for validity. Missing signatures, incorrect witnesses, or unclear instructions can make the document open to challenge. Courts may then need to decide what the deceased intended, which can delay the distribution of assets.

We have seen cases where multiple versions of a will caused confusion and conflict among family members. In one example, a man left behind several handwritten wills, leading to a costly legal dispute over which one was valid. Such situations are not rare; DIY wills often create disputes that result in expensive court battles.

Common causes of litigation include:

Improper witnessing that makes the will invalid.

Ambiguous language that leaves room for interpretation.

Failure to update the will after major life events.

Professional drafting helps ensure the will reflects our true intentions and complies with legal requirements in our province.

Unintended Tax Implications

A poorly written will can lead to unnecessary taxes that reduce the estate’s value. Many people do not consider how capital gains, probate fees, or income taxes apply to inherited assets. Without proper planning, beneficiaries may pay more than needed.

DIY wills often ignore how assets such as joint accounts, registered investments, and life insurance are treated at death. Beneficiary designations and ownership structures can greatly affect how assets are distributed and taxed.

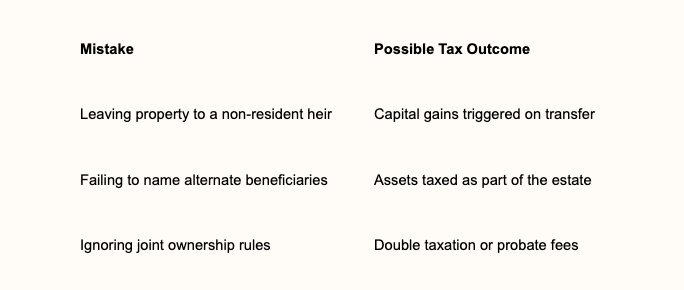

To illustrate, consider the following table:

By consulting a qualified estate lawyer, we can structure our wills to minimize taxes and ensure our beneficiaries receive their intended inheritance efficiently.

Problems with Executor Selection

Choosing the right executor affects how smoothly an estate is managed. Poor choices can cause delays, disputes, or unnecessary costs. We often see issues arise when executors lack the skills, time, or judgement to handle complex responsibilities.

Appointing Unsuitable Executors

Many people name a close friend or family member without considering whether that person can meet the legal and financial demands of the role. An executor must be organized, impartial, and willing to communicate clearly with beneficiaries.

When someone lacks these qualities, estate administration can stall. According to Canadian Family Offices, executors often underestimate the time and effort required to manage an estate. This can lead to errors in asset distribution or missed deadlines for tax filings.

We should also consider potential conflicts of interest. Naming an executor who is also a major beneficiary can create tension among heirs. In some cases, appointing a professional executor or co-executor provides a more balanced and efficient approach.

Key considerations when selecting an executor:

Ability to manage complex paperwork and deadlines

Willingness to act impartially

Availability and proximity to the estate

Financial literacy and attention to detail

Lack of Alternate Executors

Failing to name an alternate executor is another common mistake. If the primary executor dies, becomes ill, or refuses the role, the court must appoint someone else, which can delay estate settlement.

Estates can remain in limbo when no one is authorized to act. This can even delay funeral arrangements or access to essential documents.

We recommend naming at least one alternate executor in every will. The alternate should meet the same standards as the primary executor and be aware of their potential duties.

Checklist for naming alternates:

Misunderstandings About Estate Assets

Many people misunderstand what counts as an estate asset. We often see clients assume that all property, accounts, and insurance payouts automatically form part of the estate. In reality, some assets pass directly to named beneficiaries and never go through the will.

Common non‑estate assets include:

Registered accounts with designated beneficiaries (such as RRSPs or TFSAs)

Life insurance proceeds

Jointly owned property with rights of survivorship

Failing to recognize these differences can lead to disputes or unequal distributions. Unclear ownership and beneficiary arrangements often create confusion and legal challenges.

We also find that families sometimes overlook digital assets such as online accounts or cryptocurrency. Failing to include these modern assets in a will or estate plan can cause delays and loss of value.

We encourage clear documentation and regular updates to ensure all estate assets are handled as intended.

Failure to Address Digital Assets

We often see clients overlook their digital assets when preparing a will. These include online accounts, cryptocurrencies, photos, and other digital property. Ignoring them can lead to confusion, loss of value, and disputes among heirs.

Digital assets are now a regular part of estate planning. Courts in BC increasingly deal with disputes involving crypto and online accounts. Without clear instructions, executors may struggle to access or manage these items.

Common digital assets to include in a will:

Email and social media accounts

Online banking and investment platforms

Digital wallets and cryptocurrency

Cloud storage and photo libraries

Subscription services or online businesses

A National Law Review article on digital estate planning notes that many people assume their families can automatically access online accounts. In reality, privacy laws and platform policies often prevent this.

We recommend keeping a digital asset inventory that lists each account, access method, and any related instructions. This record helps executors locate and transfer digital property efficiently.

Ineffective Guardianship Provisions

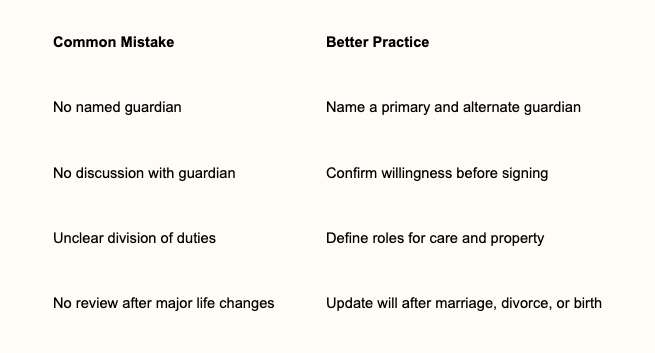

When we review wills, we often find vague or incomplete guardianship provisions. These sections are critical when the testator has minor children or dependants who cannot manage their own affairs. If the will does not clearly identify a guardian, the court may need to decide, which can lead to family conflict and delay.

We also see problems when the chosen guardian is not informed or prepared for the role. A good practice is to discuss the appointment in advance to ensure the person is willing and able to take on the responsibility. Without this step, the guardian may decline, leaving the family uncertain about who will care for the dependants.

Some wills fail to address the guardian’s authority over both personal care and property management. Disputes often arise when one person is responsible for financial decisions and another for personal care. This division can cause confusion and disagreement about what is in the best interests of the dependant.

To help clients avoid these issues, we recommend including clear instructions and backup appointments. The table below outlines common mistakes and better approaches:

Overlooking Charitable Bequests

When we draft or review wills, we often see clients forget to include charitable bequests even when they have supported certain causes throughout their lives. A charitable bequest allows us to leave part of our estate to a registered charity through our will, helping important organizations continue their work.

Failing to identify the charity correctly is a common mistake. Many charities have similar names, and using the wrong one can cause confusion or even invalidate the gift. It is important to confirm the legal name and registration number of the organization using reliable resources such as the Government of Canada’s charity database.

We also see issues when clients do not specify the type of gift. Charitable bequests can take several forms:

Including clear instructions in the will helps ensure the executor can carry out the donor’s wishes. Working with an estate lawyer can also ensure the bequest meets legal requirements and aligns with tax planning strategies, as noted in Charitable Bequests in Canada: Giving Through Your Will.

Ignoring the Impact of Marriage and Divorce

We often see clients overlook how marriage and divorce change the legal effect of their wills. Under the province’s Wills, Estates and Succession Act (WESA), marriage no longer revokes an existing will - unlike the previous BC law and current rules in some provinces - so a new spouse will not automatically receive rights unless the will is updated. If someone in Vancouver marries and wishes for their new spouse to inherit, they must update their will to reflect these intentions. Otherwise, the spouse may receive less than expected under BC’s intestacy rules.

Divorce or permanent separation, on the other hand, does impact how a will operates in BC. WESA provides that, unless the will-maker states otherwise, any gifts or appointments made to a former spouse are automatically revoked after divorce or a qualifying separation treating the former spouse as though they predeceased the will-maker. If a will is not updated, this can lead to unintended beneficiaries or gaps in the estate plan.

Long-term separations and common-law breakdowns are also recognized under BC law, so careful estate planning and regular updates are essential to ensure your will reflects your true wishes.

To help clients understand these changes, we often summarize key points:

We advise reviewing wills after any major relationship change to ensure they still reflect our clients’ intentions and comply with current law.

Inadequate Communication with Family Members

We often see families struggle because they did not discuss their estate plans before a death occurred. When relatives learn about a will for the first time after someone passes away, confusion and resentment can quickly follow. Clear communication helps reduce misunderstandings and emotional conflict.

Explaining decisions to family members before death can prevent disputes. When people understand the reasons behind certain choices, they are less likely to feel excluded or surprised.

We encourage clients to share the basics of their estate plans with key family members. This includes who the executor is, how major assets are divided, and any special instructions. Even a brief conversation can make a significant difference.

Common communication mistakes include:

Avoiding discussions about the will altogether

Assuming family members know the testator’s intentions

Failing to explain unequal distributions

Not updating relatives after making major changes

Open dialogue also helps set expectations and ensures that everyone understands their role. Poor communication often leads to unnecessary legal and emotional strain.

The Final Verdict

Many common will-related mistakes such as unclear wording, outdated information, or missing legal formalities can easily be avoided with proper legal guidance. Taking the time to create and maintain a well-drafted will ensures your wishes are respected and your loved ones are protected.

To avoid these costly and stressful errors, contact us at Parr Business Law. Our experienced team can help you craft a legally sound, comprehensive will that reflects your intentions and stands the test of time.